Billionaire fund manager exits stake in soaring tech giant

NegativeFinancial Markets

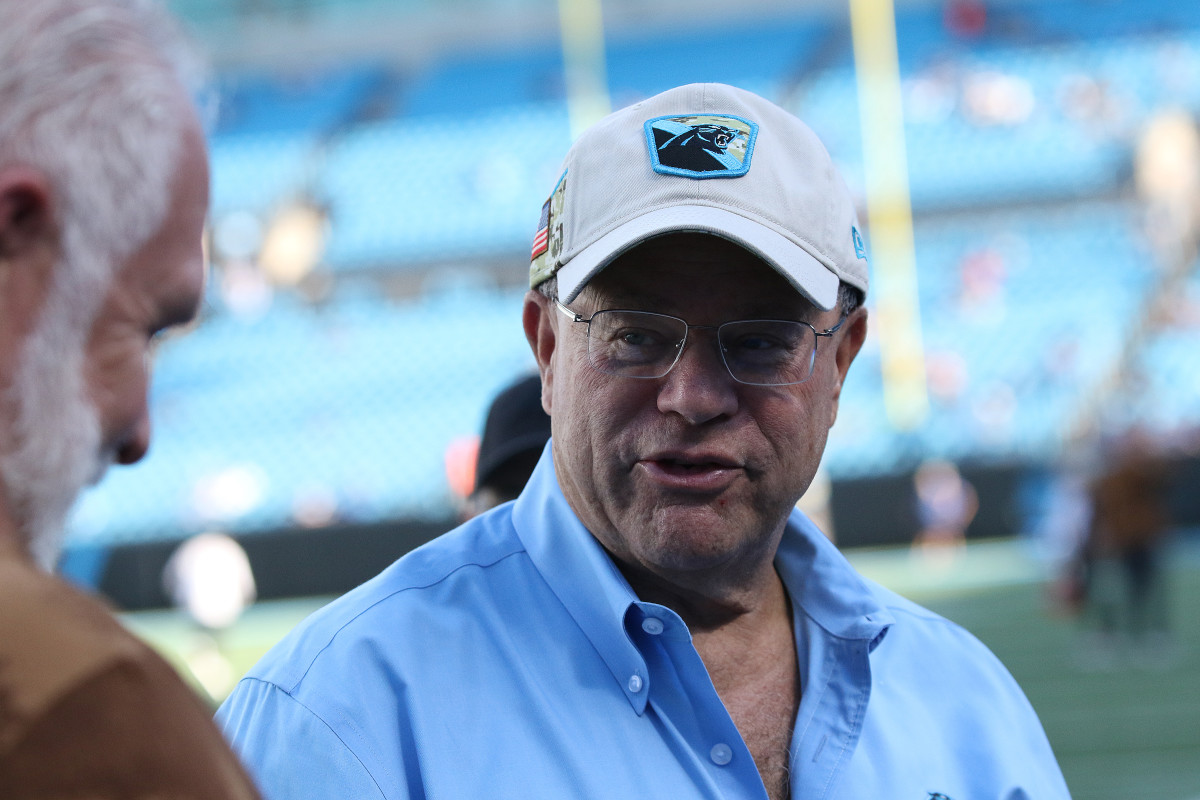

- David Tepper has exited his stake in Intel, marking a complete withdrawal from the tech giant's stock amid a notable rally that saw its shares surge nearly 50%. This increase was fueled by positive developments in the foundry sector, government backing, and a resurgence of investor confidence in Intel's turnaround prospects.

- Tepper's exit signals a cautious stance towards Intel, despite its recent stock performance. This move could reflect concerns about the sustainability of the rally and may influence other investors' perceptions of Intel's future, potentially impacting the company's market position.

— via World Pulse Now AI Editorial System