BofA sees consumer pain increasing from controversial economic policy

NegativeFinancial Markets

BofA sees consumer pain increasing from controversial economic policy

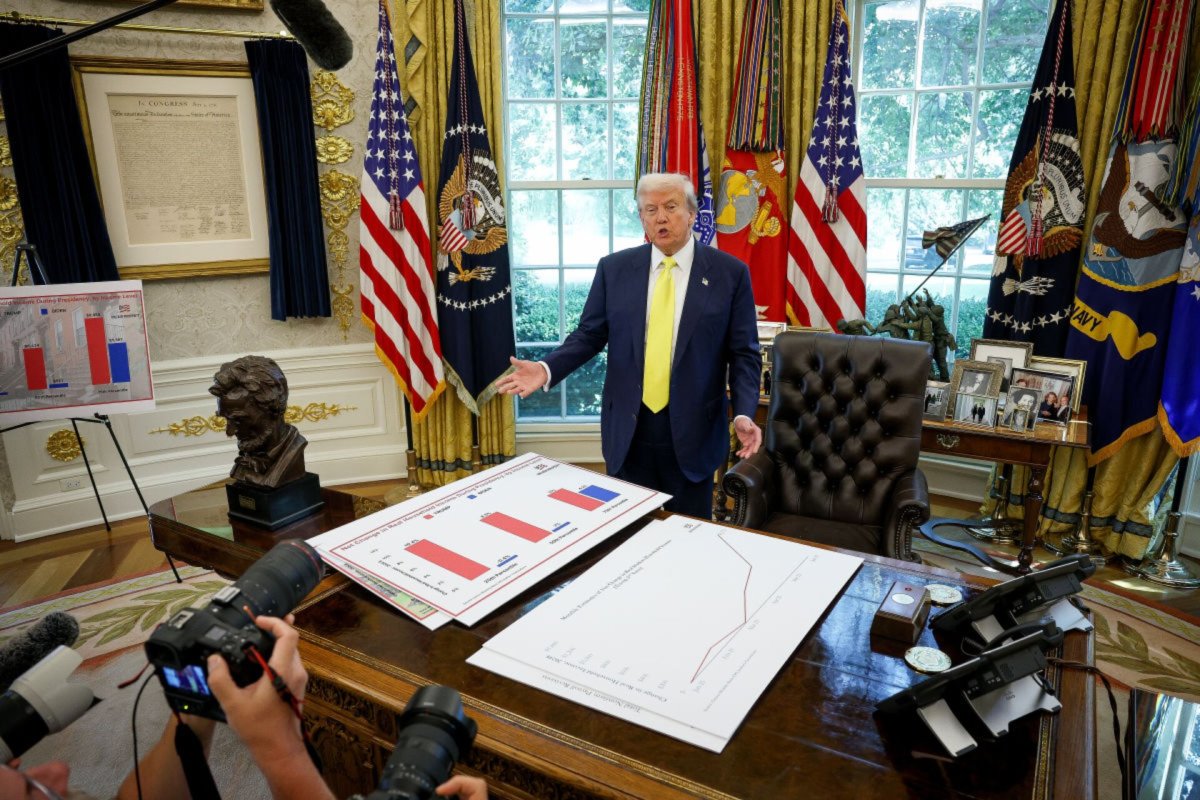

Bank of America has raised concerns about the increasing financial strain on consumers due to controversial economic policies. As inflation continues to impact everyday expenses, particularly highlighted by the rising cost of essentials like eggs, many Americans are feeling the pinch. This situation is significant as it not only affects household budgets but also shapes political narratives, especially with the upcoming elections where economic issues are likely to be at the forefront.

— via World Pulse Now AI Editorial System