The Great Debasement Debate Is Rippling Across Global Markets

NeutralFinancial Markets

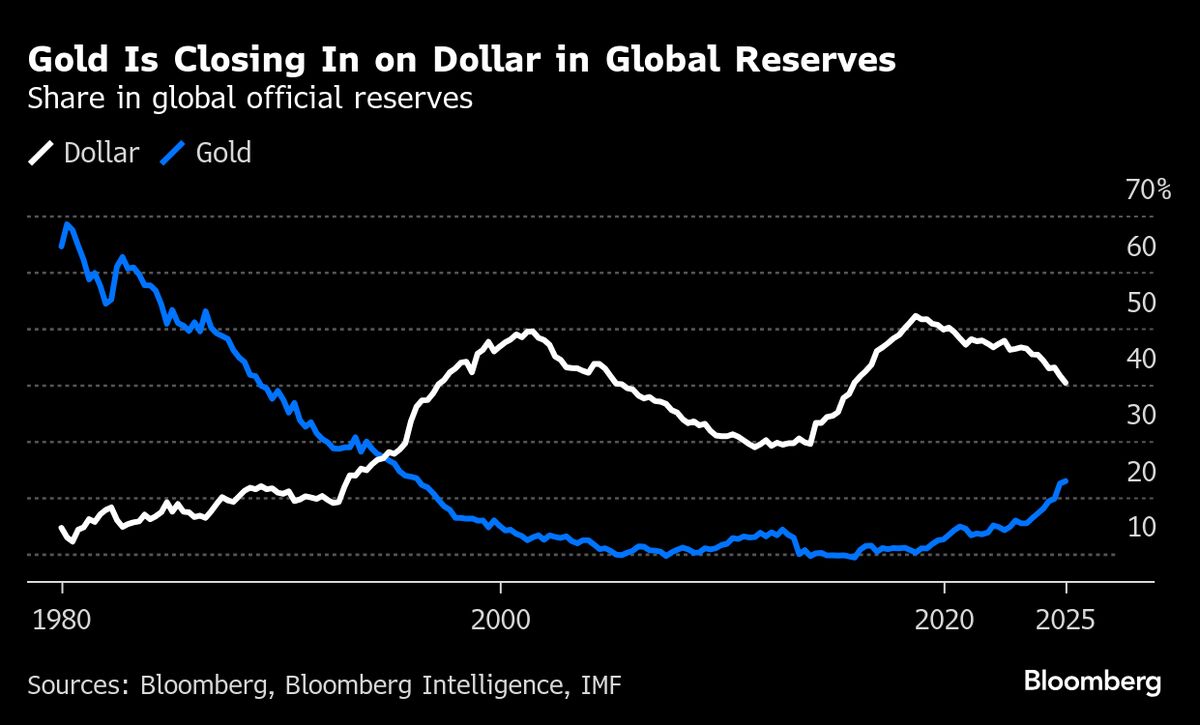

The ongoing debate about the potential devaluation of currencies is influencing global markets as investors navigate the complexities of rising budget deficits. This situation is significant because it highlights the need for investors to reassess their strategies and protect their assets against long-term financial instability.

— via World Pulse Now AI Editorial System