VIX Curve Inversion Tests Trader Resolve With Volatility Rising

NeutralFinancial Markets

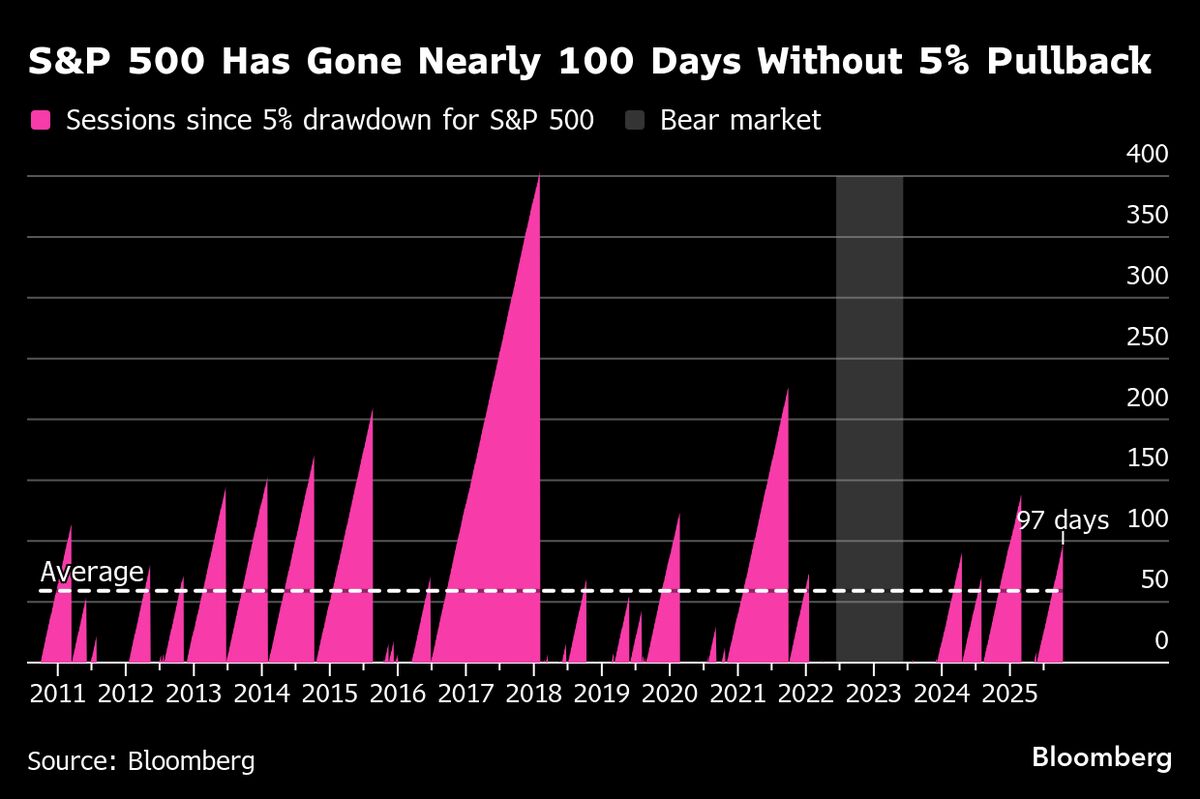

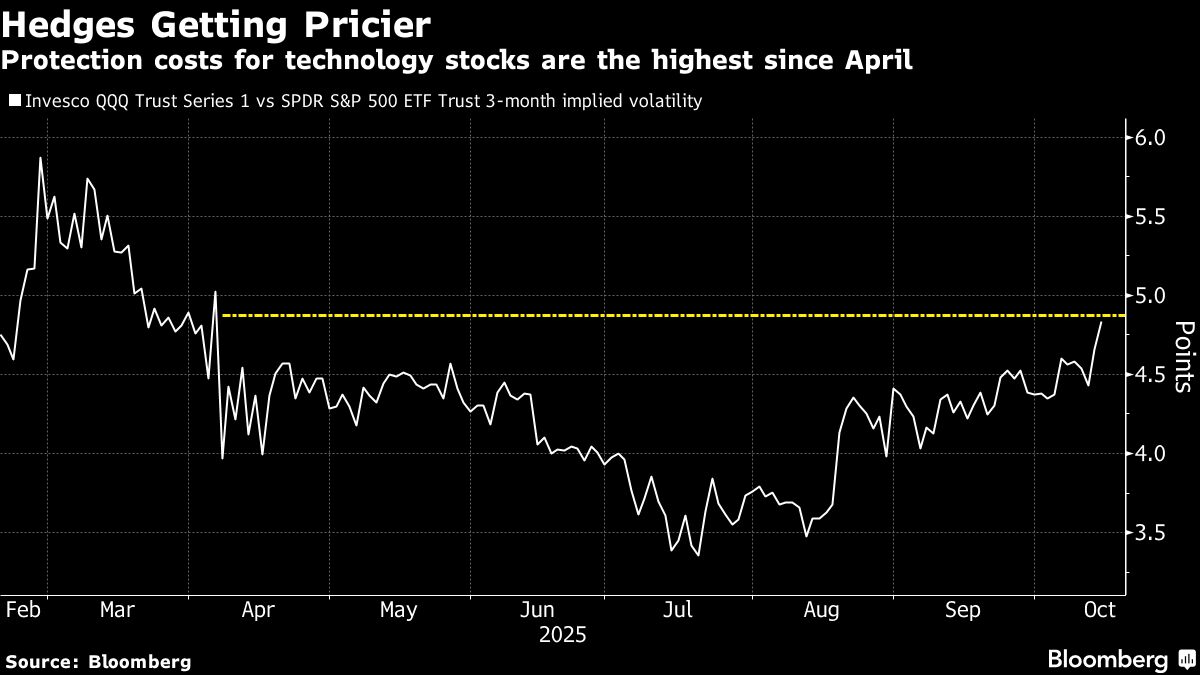

This week, the S&P 500 Index has managed to recover half of its recent losses, providing some relief to equity bulls who were shaken by new trade-war tensions. However, the bears remain steadfast, indicating that the market's volatility is still a concern. This situation is significant as it highlights the ongoing tug-of-war between bullish and bearish sentiments in the market, which can impact investor confidence and trading strategies.

— Curated by the World Pulse Now AI Editorial System