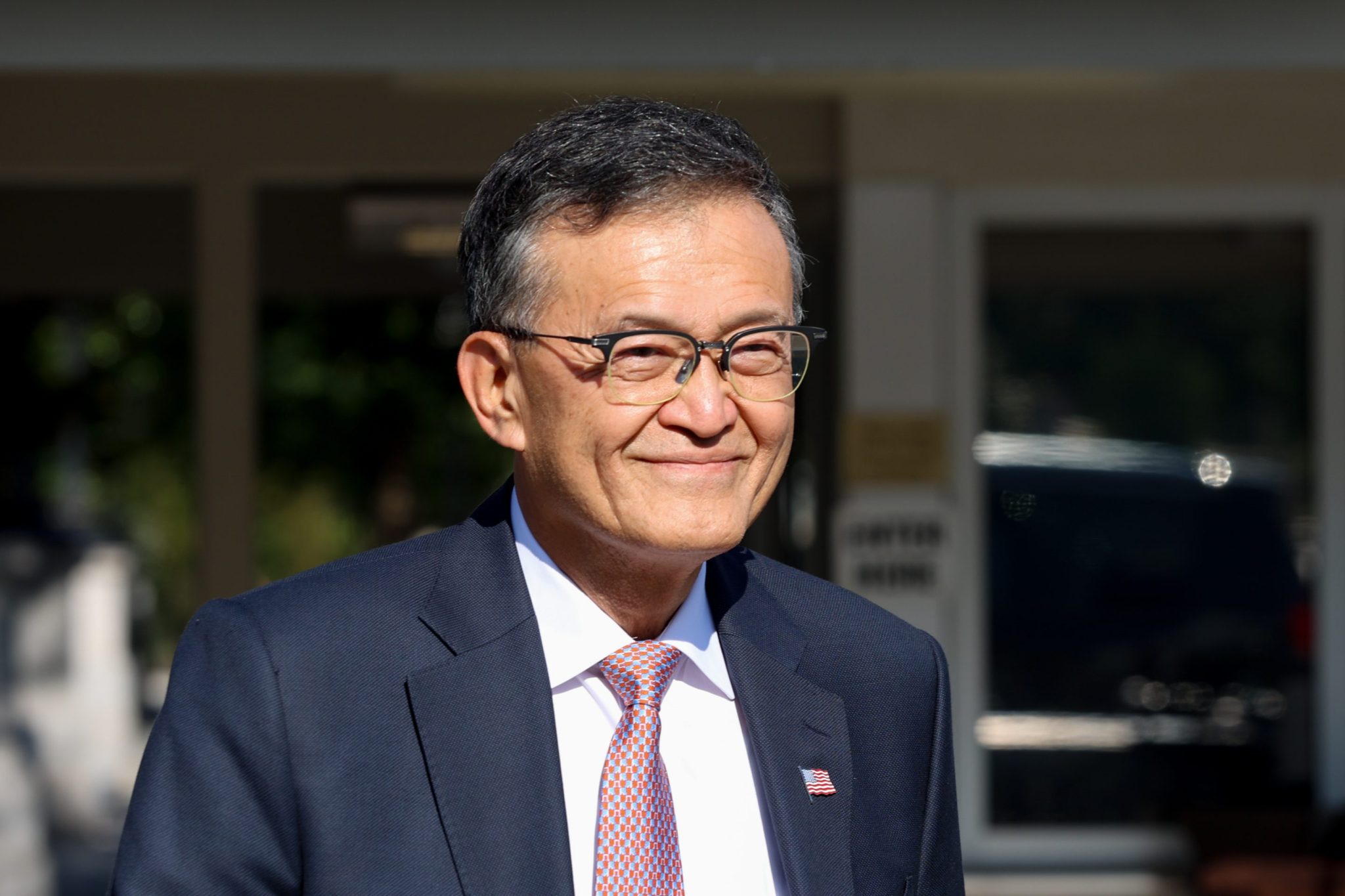

Japan PM contender Koizumi vows wage hikes to counter inflation

PositiveFinancial Markets

Japan's Prime Minister contender, Koizumi, has pledged to implement wage hikes as a strategy to combat rising inflation. This commitment is significant as it aims to improve the financial well-being of workers and stimulate the economy. By addressing wage growth, Koizumi hopes to alleviate the pressures of inflation on households, making this a crucial issue for voters who are concerned about their purchasing power.

— Curated by the World Pulse Now AI Editorial System