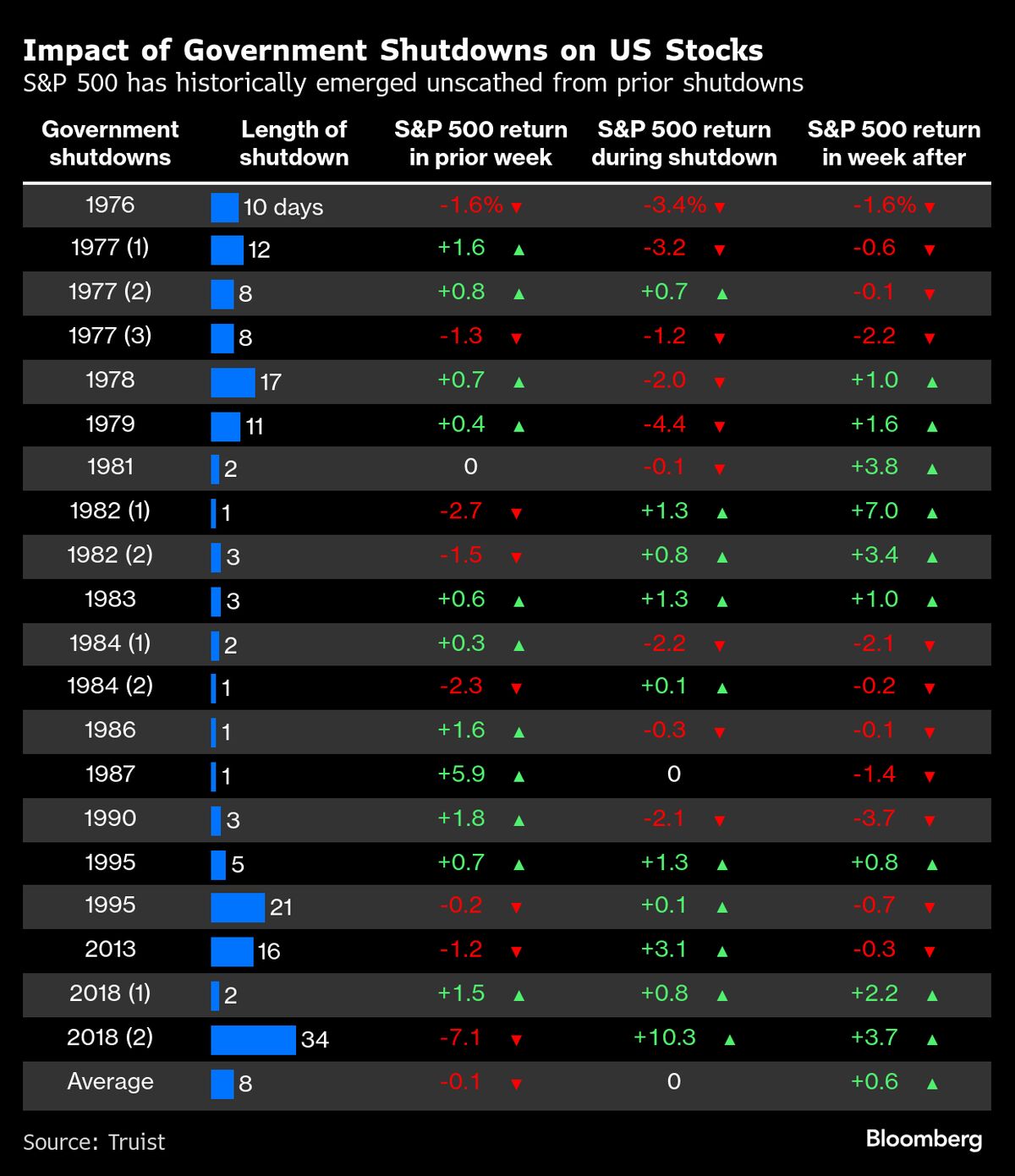

Government Shutdown Watch: Imminent As Partisan Stalemate Over Healthcare Remains Ahead Of Midnight Deadline

NegativeFinancial Markets

As the clock ticks down to midnight Tuesday, the looming government shutdown is a pressing concern as Congress struggles to reach a consensus on a new spending plan. This stalemate, primarily driven by partisan disagreements over healthcare, could have significant implications for federal services and employees. It's a critical moment that highlights the ongoing challenges in U.S. governance and the impact of political divisions on everyday citizens.

— Curated by the World Pulse Now AI Editorial System