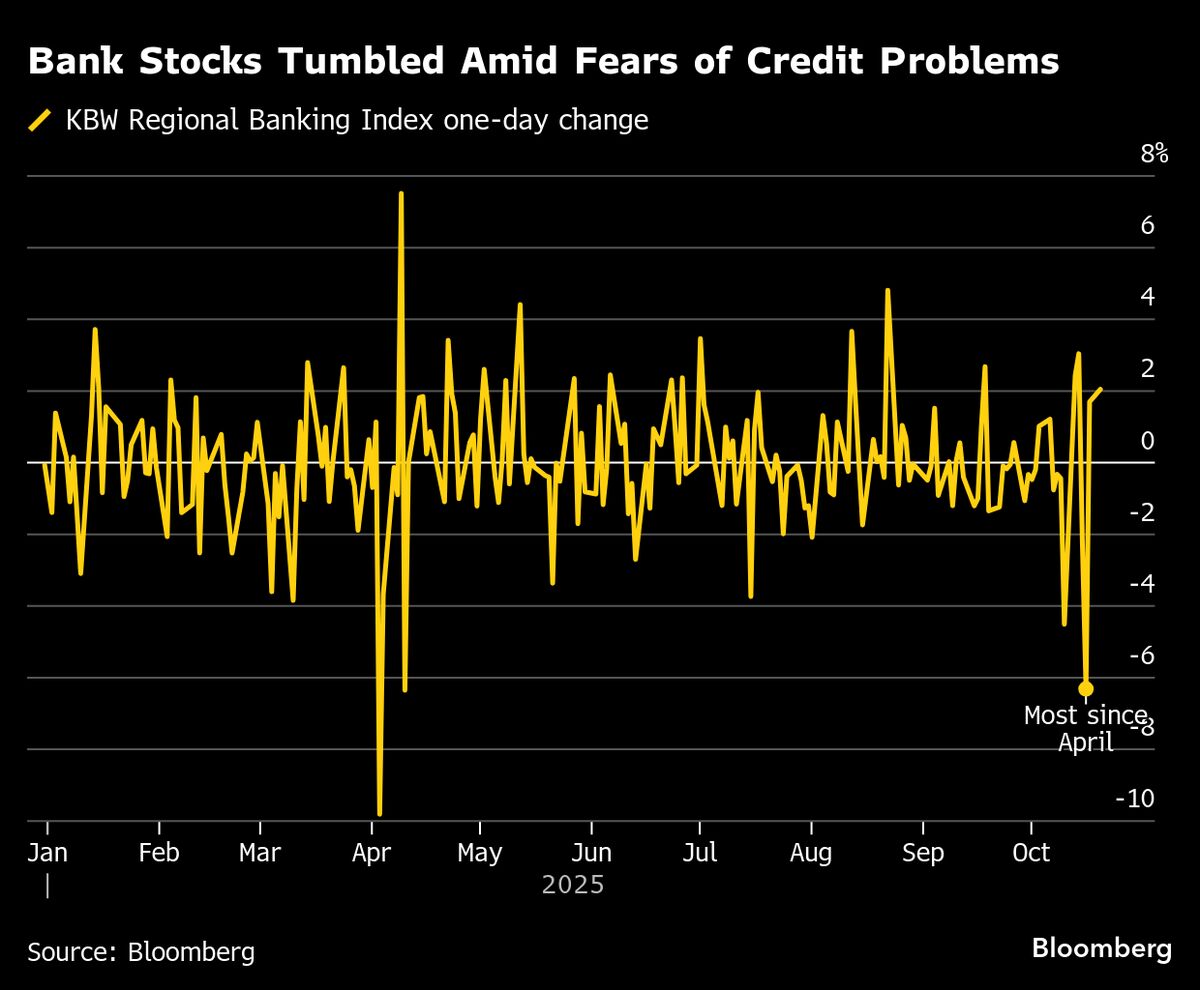

BofA Warns of Forced Stocks Selling If Credit Problems Persist

NegativeFinancial Markets

Bank of America has raised alarms about potential forced selling in the stock market if credit issues continue to escalate. This situation could lead to significant losses for long-only investors, such as pension funds, who may have no choice but to liquidate their holdings. Understanding these dynamics is crucial as they could trigger a broader market downturn, affecting not just investors but the overall economy.

— Curated by the World Pulse Now AI Editorial System