Gold Steady as Traders Weigh Weak US Jobs Data, Fed Comments

NeutralFinancial Markets

Gold Steady as Traders Weigh Weak US Jobs Data, Fed Comments

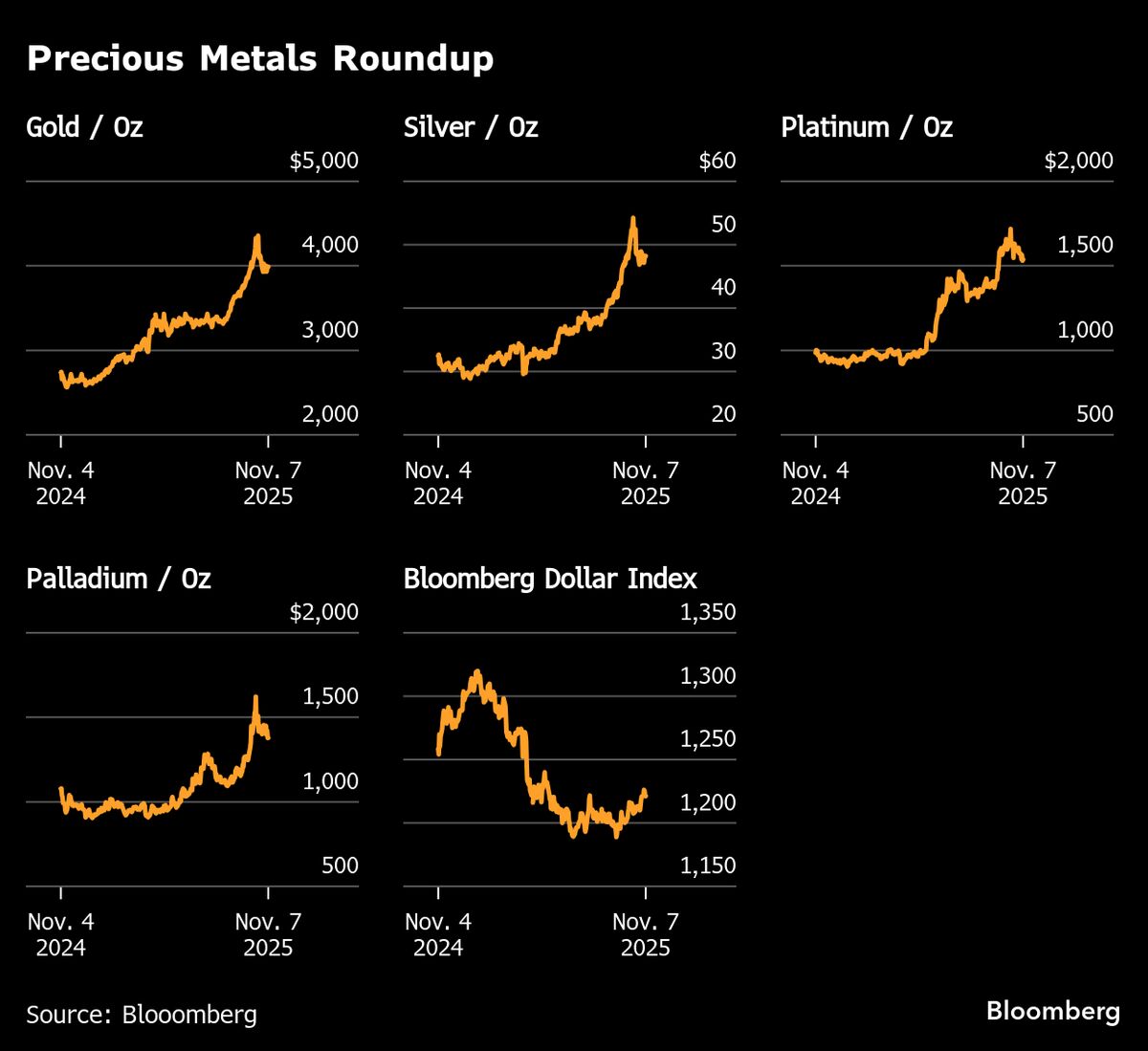

Gold prices remained stable as traders assessed the impact of unexpectedly weak US employment data alongside remarks from a Federal Reserve official that tempered hopes for additional interest-rate cuts. This balance is crucial as it reflects the ongoing uncertainty in the market, influencing investment strategies and economic forecasts.

— via World Pulse Now AI Editorial System