Blackstone and TPG Agree to $18 Billion Deal to Buy Hologic

PositiveFinancial Markets

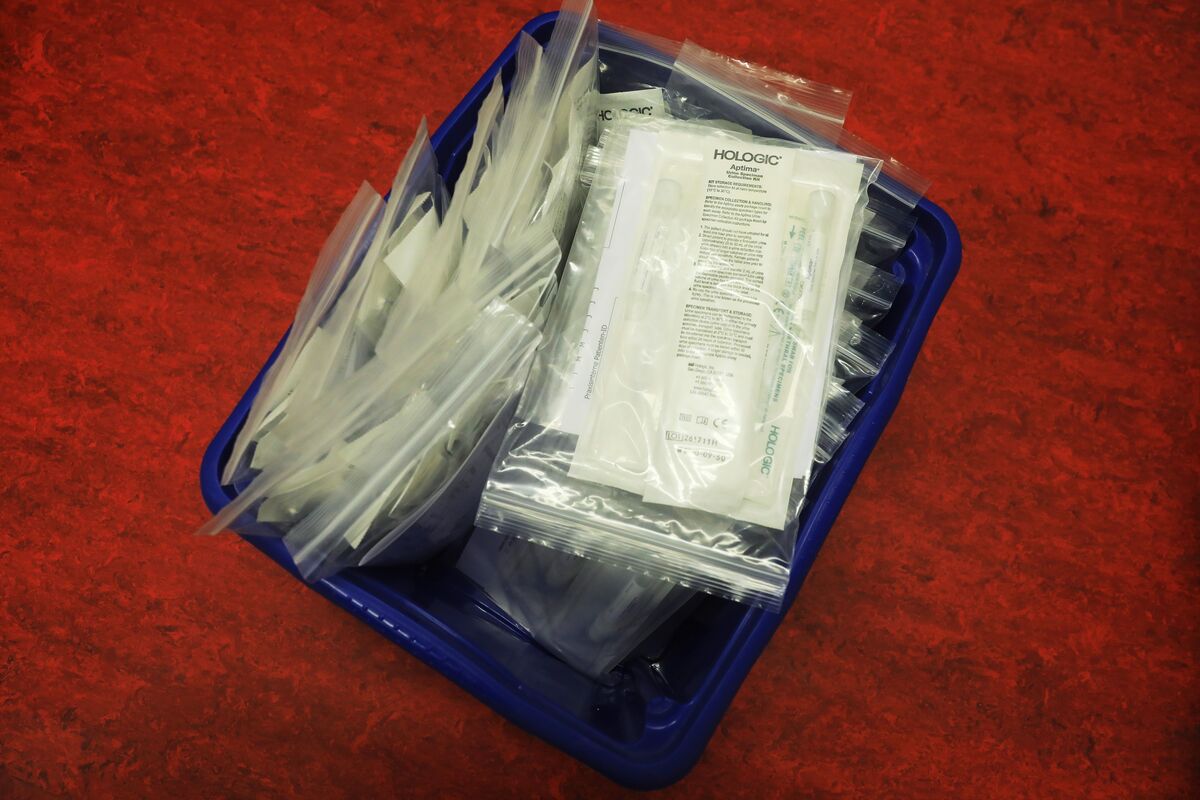

Blackstone and TPG have struck a significant deal to acquire Hologic for up to $18.3 billion, marking a notable moment in the thriving private equity landscape. This acquisition highlights the growing interest in the medical device sector and reflects the robust activity in mergers and acquisitions, which is crucial for innovation and growth in healthcare.

— Curated by the World Pulse Now AI Editorial System