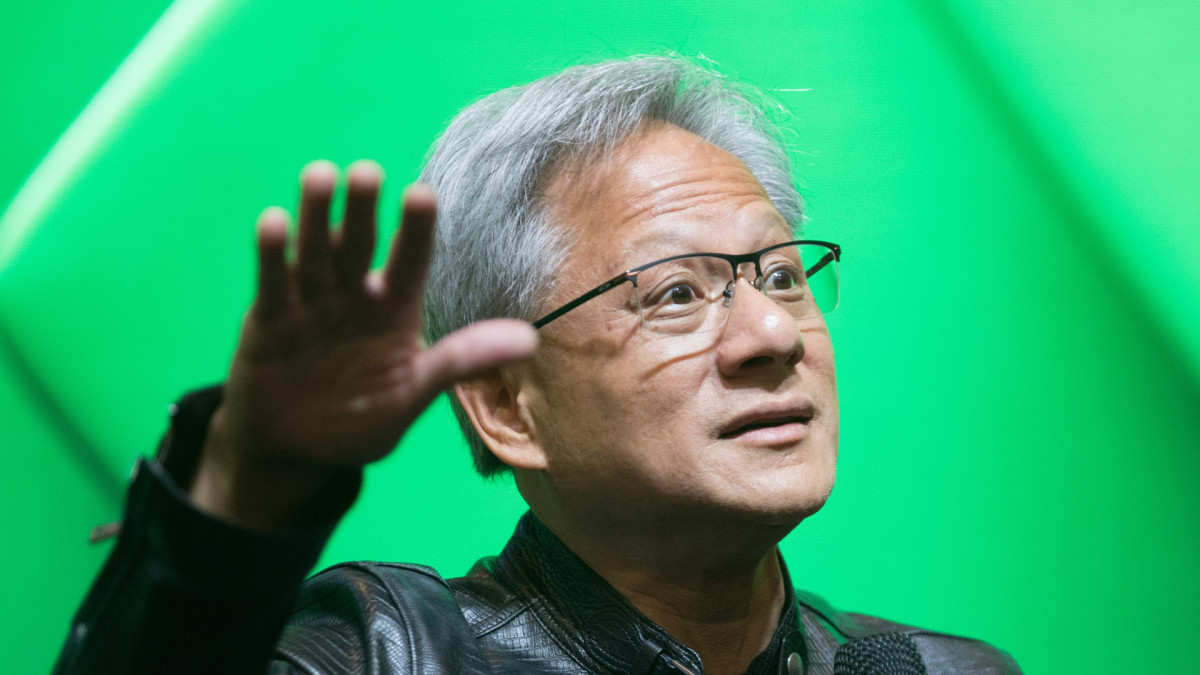

Europe’s Industrial Firms to Stand Out on AI, Defense Spending

PositiveFinancial Markets

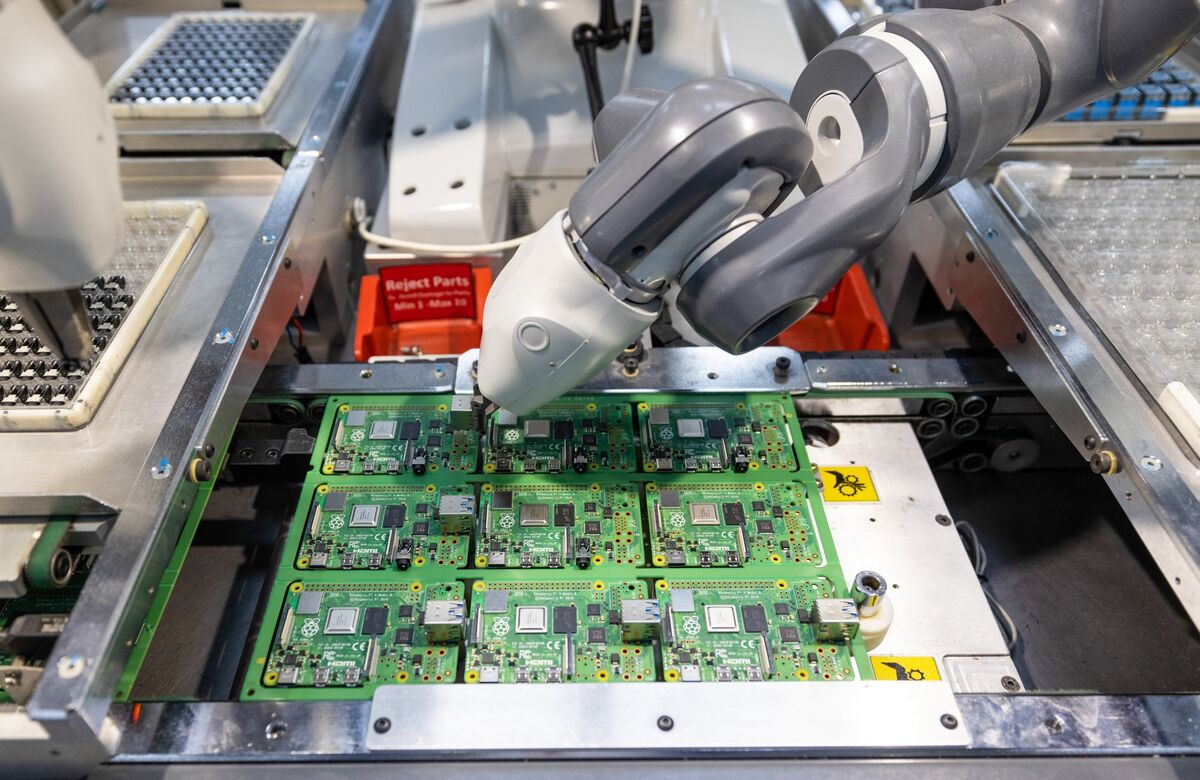

European industrial firms are set to shine this earnings season, driven by a surge in artificial intelligence and defense spending. This positive trend is significant as it highlights the resilience and adaptability of the manufacturing sector, particularly in infrastructure and weapons production, which are becoming increasingly vital in today's geopolitical landscape.

— Curated by the World Pulse Now AI Editorial System