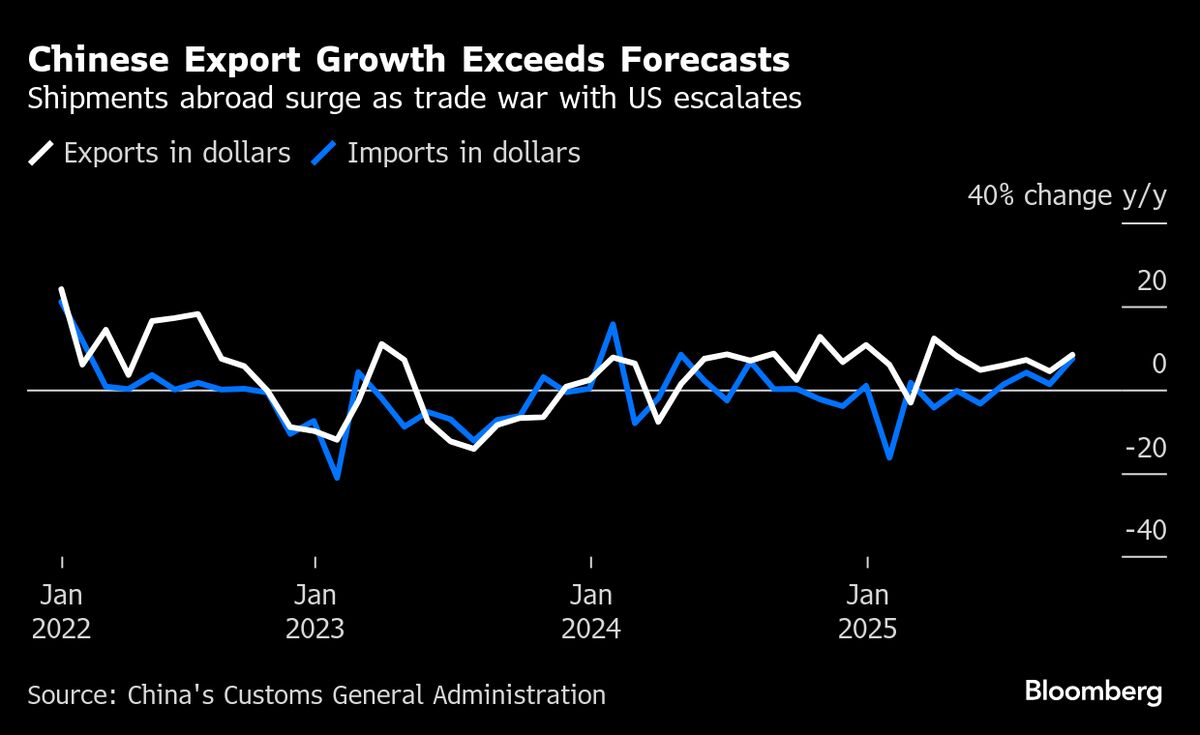

China’s exports top forecast but fresh US trade spat raises risks to outlook

NeutralFinancial Markets

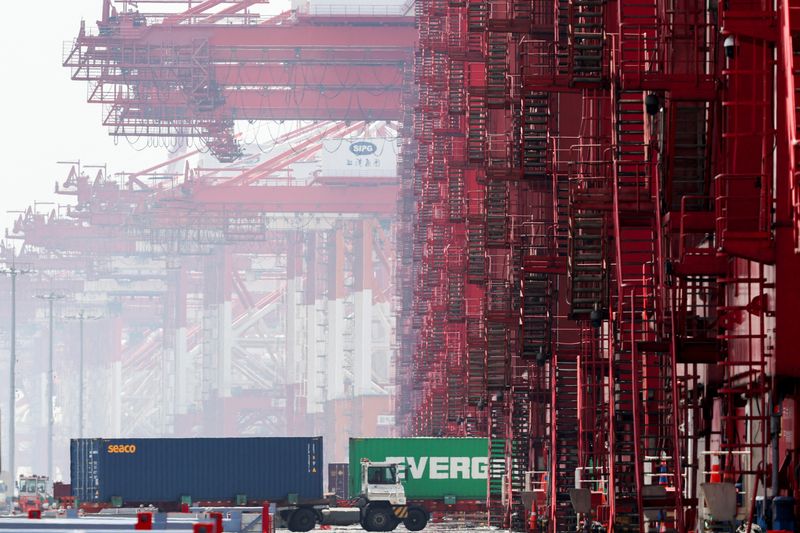

China's exports have exceeded expectations, showcasing resilience in its economy despite ongoing tensions with the United States. This development is significant as it highlights China's ability to navigate global trade challenges, but the fresh trade spat with the US raises concerns about future economic stability and relations between the two countries.

— Curated by the World Pulse Now AI Editorial System