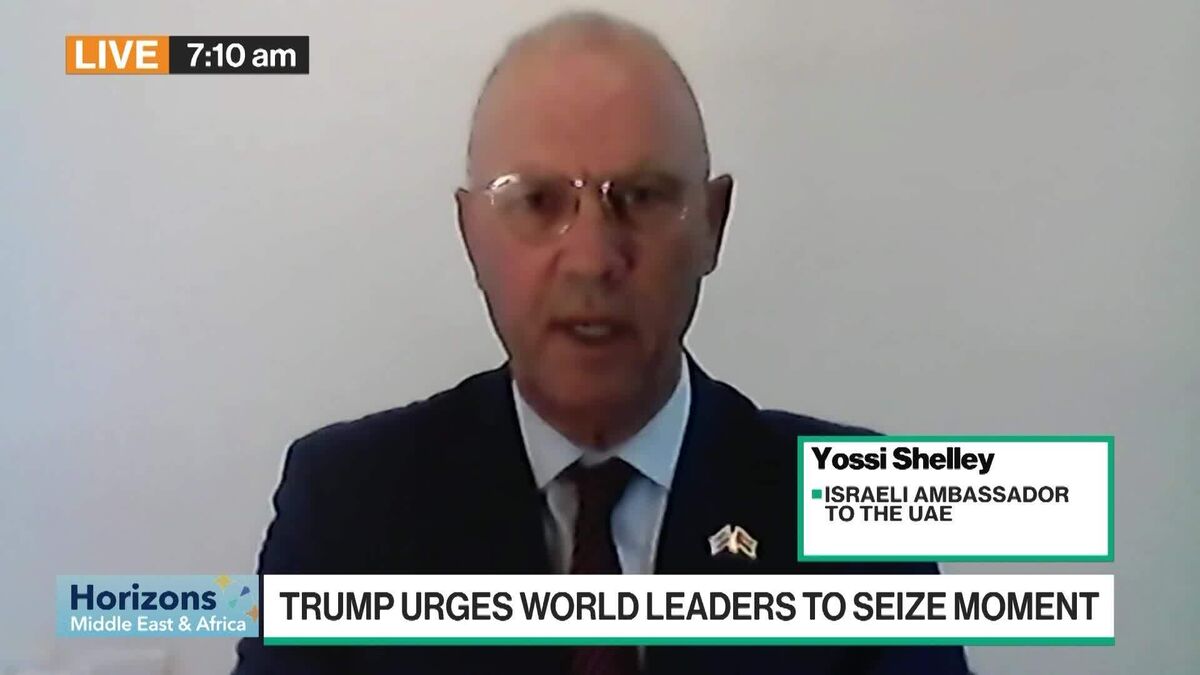

Shelley on Peace Deal: Arrived at an Irreversible Moment

PositiveFinancial Markets

At a recent summit, President Donald Trump urged world leaders to solidify a US-led truce between Israel and Hamas, calling it a 'new beginning' for Gaza. Yossi Shelley, Israel's Ambassador to the UAE, emphasized that with the involvement of Arab nations and Trump's support, they have reached an irreversible moment towards lasting peace. This development is significant as it highlights a potential shift in the long-standing conflict, offering hope for stability in the region.

— Curated by the World Pulse Now AI Editorial System