Exxaro CEO Says Copper Ambitions Remain But Now More Modest

NeutralFinancial Markets

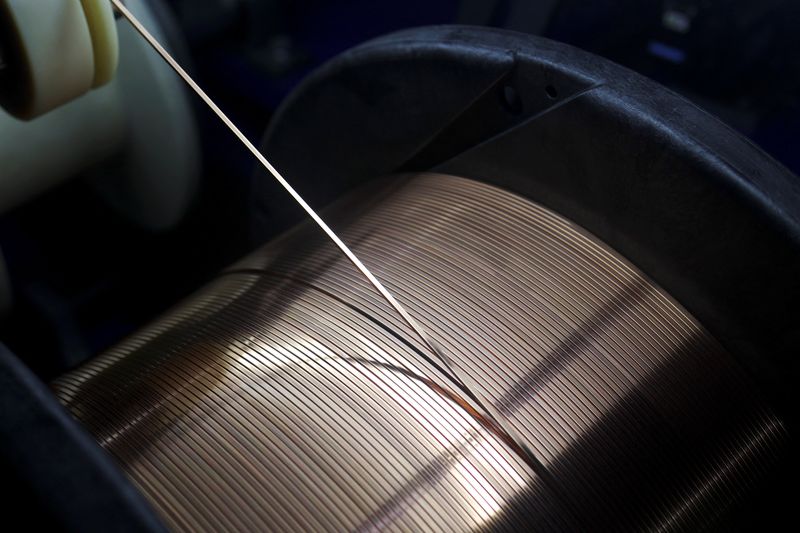

Exxaro Resources Ltd., a prominent South African coal producer, is still interested in acquiring copper assets, although its ambitions have become more modest after missing out on a mine in Botswana. The new CEO's comments highlight a strategic shift in the company's approach to copper investments, reflecting the challenges and opportunities in the mining sector. This matters because it indicates how companies are adapting their strategies in response to market dynamics and competition.

— Curated by the World Pulse Now AI Editorial System