Gold-Backed ETF Buyers Retreat After Bullion Suffers a Rout

NegativeFinancial Markets

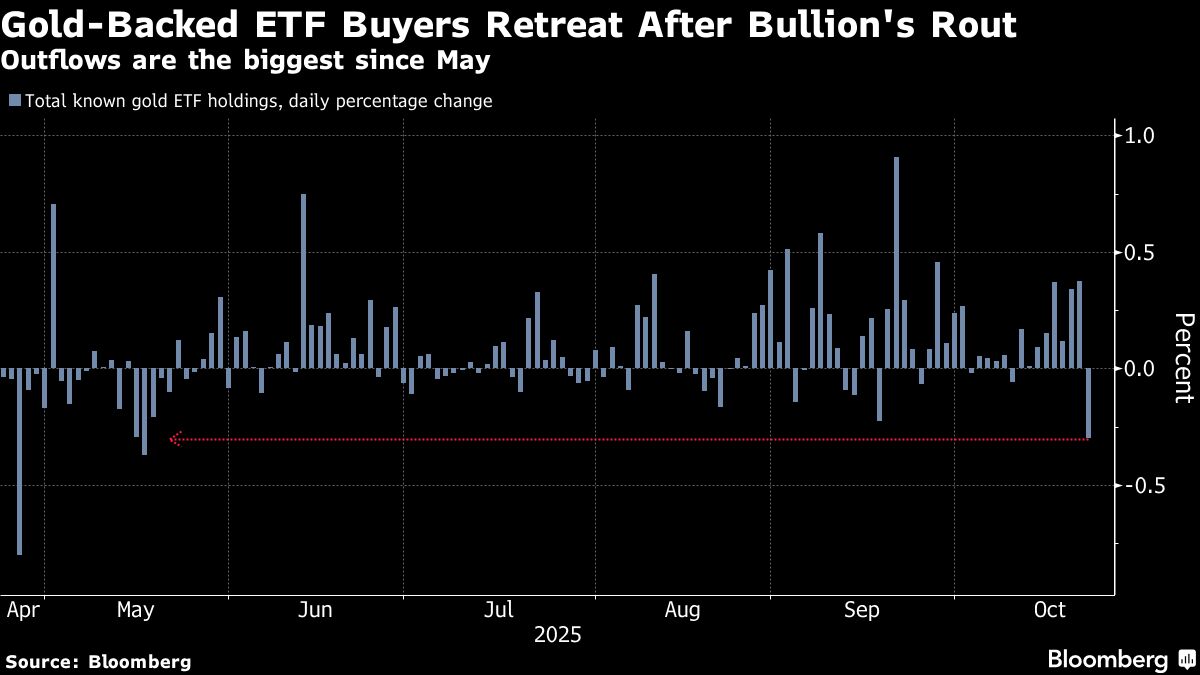

This week, buyers of gold-backed exchange-traded funds have pulled back as bullion prices experienced significant losses. The retreat comes amid worries that the recent price rally may have been too rapid and excessive. This shift is important as it reflects investor sentiment and market dynamics, potentially impacting future gold investments and the overall financial landscape.

— Curated by the World Pulse Now AI Editorial System