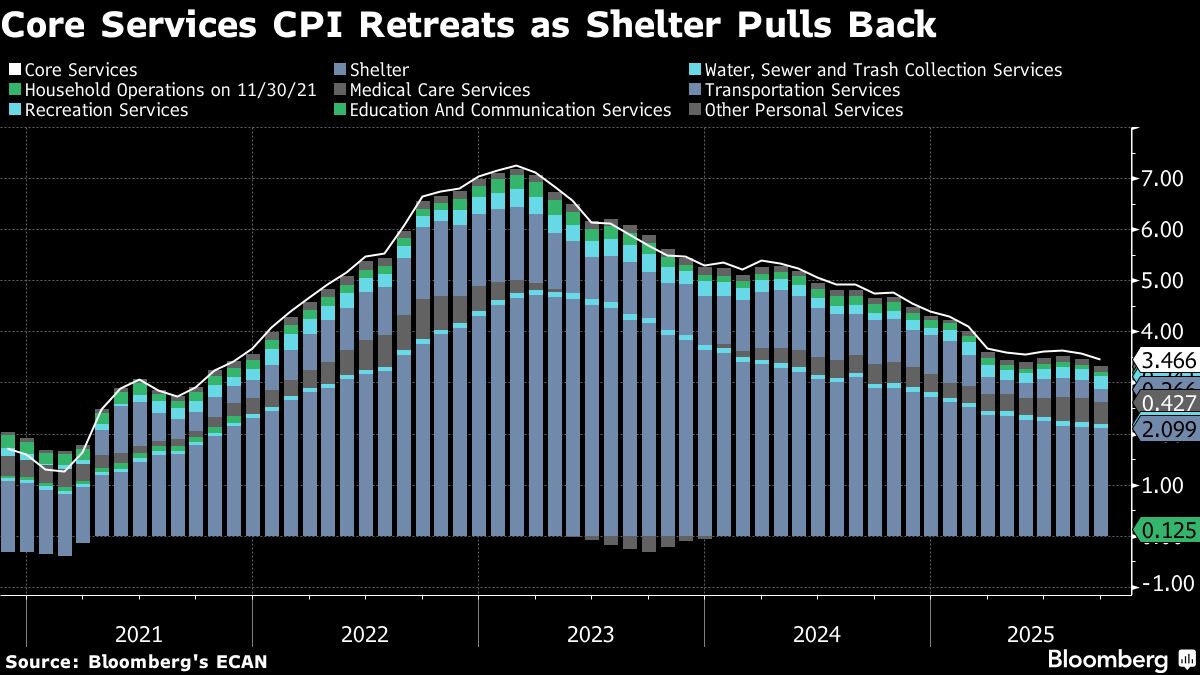

Stock Market Today: Nasdaq Composite, S&P 500 Hit Records After Delayed Inflation Report Arrives Softer Than Expected

PositiveFinancial Markets

The stock market is buzzing with excitement as both the Nasdaq Composite and the S&P 500 have reached record highs following a softer-than-expected inflation report. This news is significant as it suggests a more stable economic outlook, which can boost investor confidence and potentially lead to further market gains. As we wrap up the week, this positive momentum could set the tone for future trading sessions.

— Curated by the World Pulse Now AI Editorial System