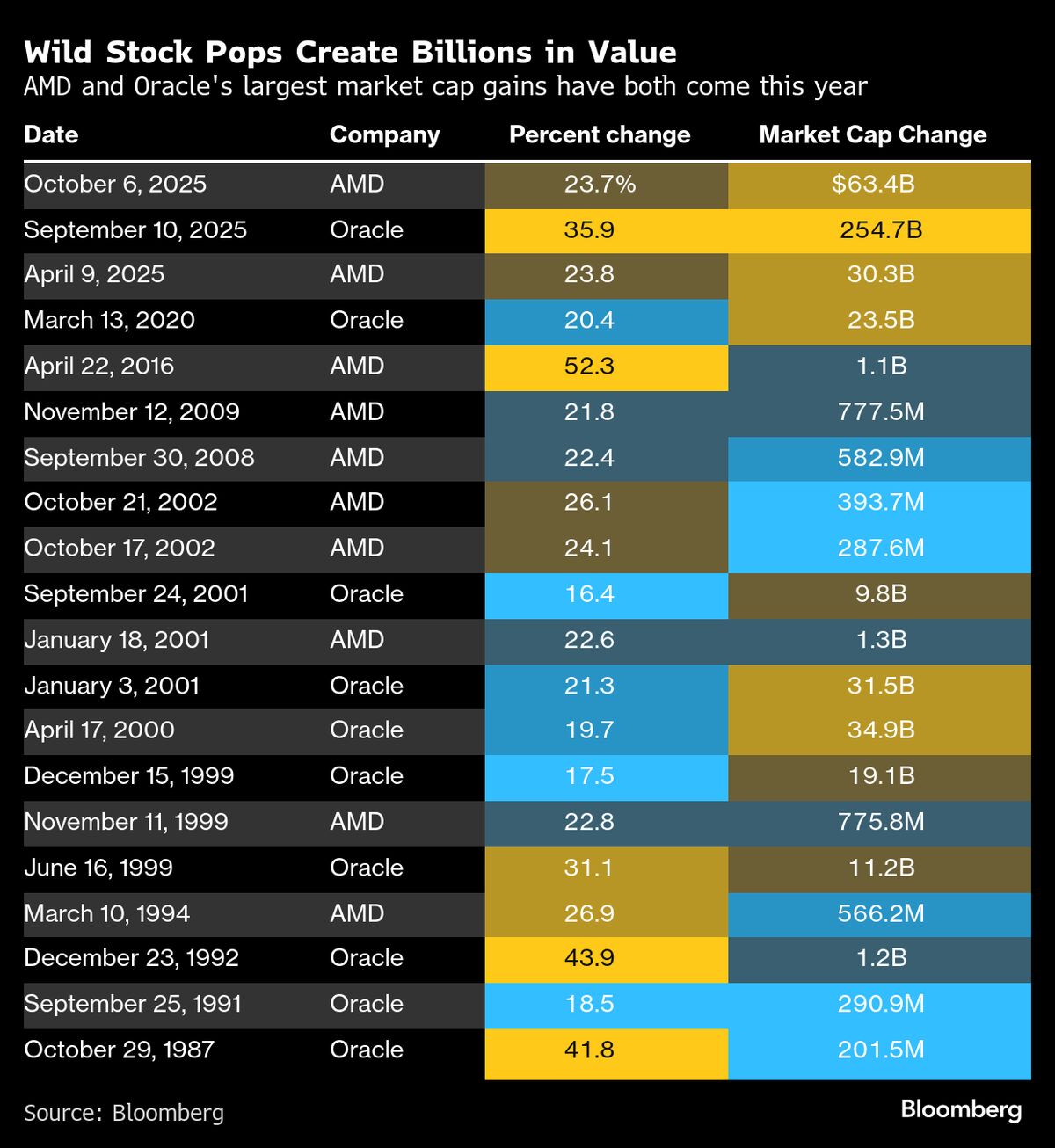

Dot-Com Fears Rise With Tech Stocks Seeing $100 Billion Swings

NegativeFinancial Markets

Investors are buzzing about OpenAI's expansion, which has led to significant gains in technology stocks. However, many Wall Street professionals are expressing concerns that the rapid fluctuations in stock values, sometimes adding tens of billions in just minutes, may indicate an unstable market reminiscent of the dot-com bubble. This situation is crucial to watch as it could impact investor confidence and market stability.

— Curated by the World Pulse Now AI Editorial System