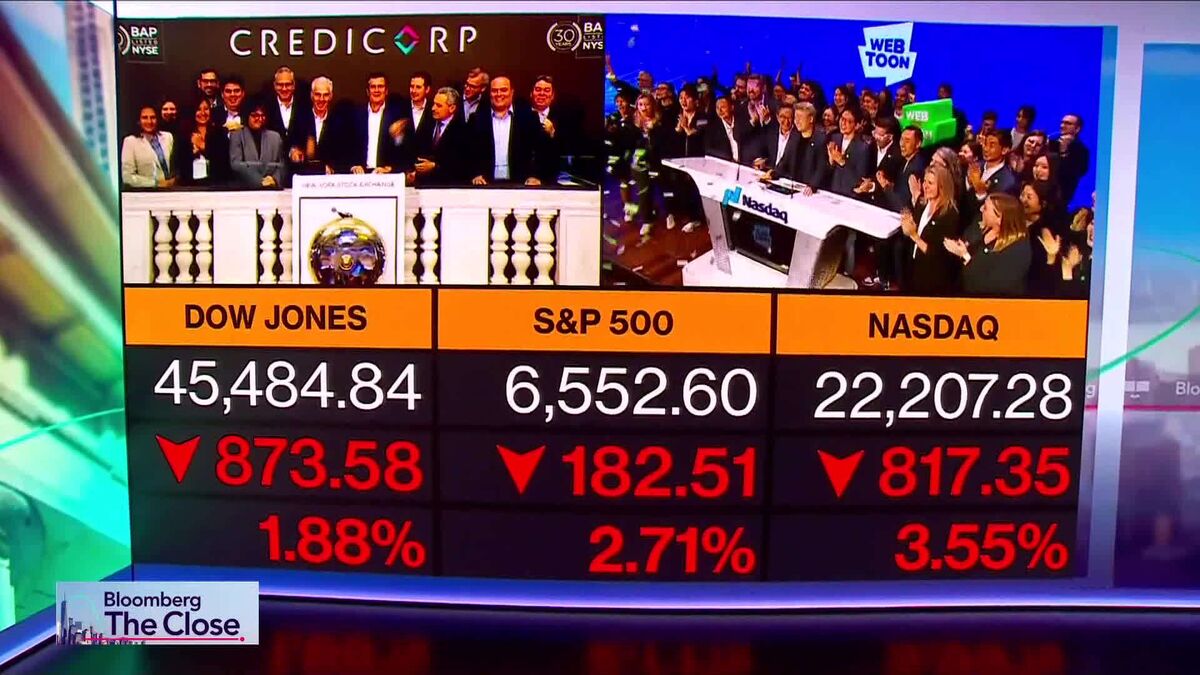

Stocks Plunge as Trump Threatens 'Massive Increase' in China Tariffs

NegativeFinancial Markets

Stocks took a significant hit as President Trump threatened a 'massive increase' in tariffs on China, escalating trade tensions that have investors worried. This turmoil not only affected the stock market but also led to declines in oil and cryptocurrency prices, prompting many to seek refuge in safer investments like Treasuries and gold. The situation is crucial as it highlights the fragility of global markets and the potential for further economic instability.

— via World Pulse Now AI Editorial System