Ice-Cream Maker Froneri Hits $17.6 Billion Valuation in Funding Deal

PositiveFinancial Markets

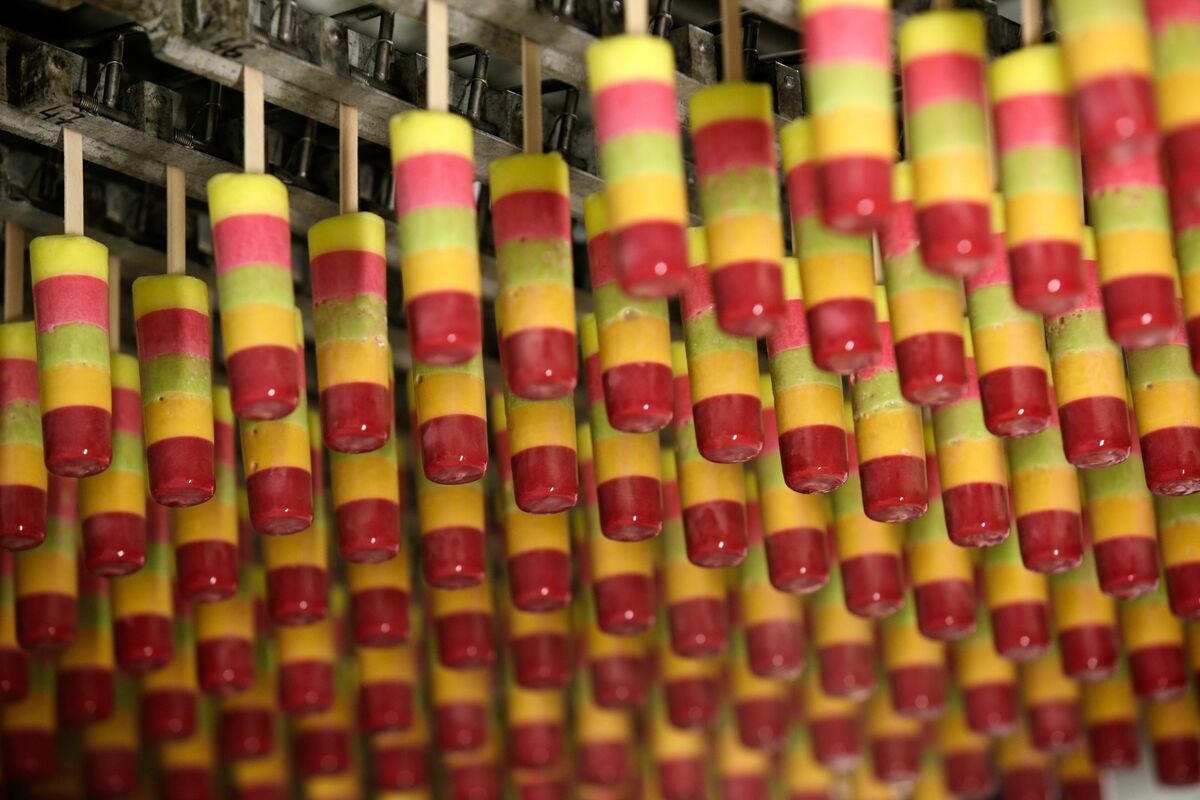

Froneri, the ice-cream maker known for its ownership of Haagen-Dazs in the U.S., has reached an impressive valuation of $17.6 billion following a significant funding deal. This investment, led by PAI Partners and the Abu Dhabi Investment Authority, totaling €1.4 billion, highlights the growing demand for premium ice cream products and the potential for expansion in the market. Such financial backing not only strengthens Froneri's position but also signals confidence in the brand's future growth and innovation.

— Curated by the World Pulse Now AI Editorial System