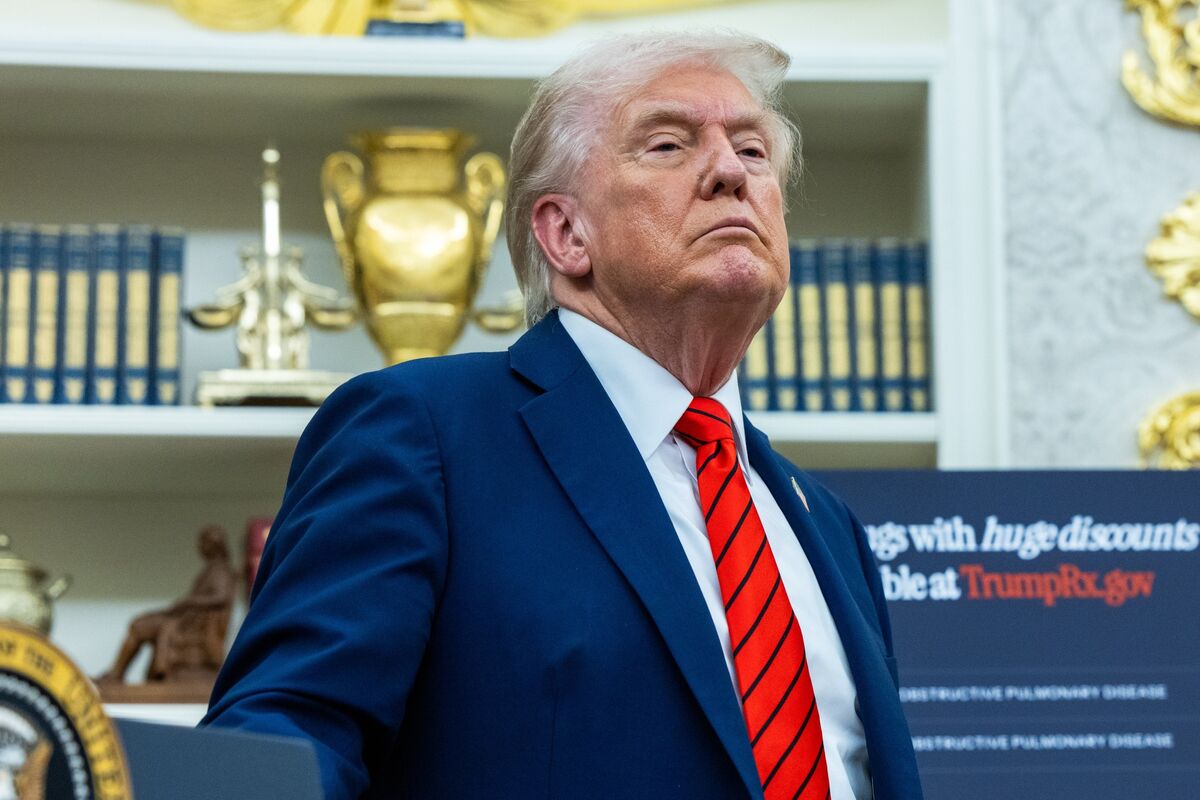

Trump’s Gaza plan hinges on security force yet to take shape

NeutralFinancial Markets

President Trump's Gaza plan is entering a more complex phase, focusing on the disarmament of Hamas and the withdrawal of Israeli forces. This stage is crucial as it aims to establish a security force that has yet to be defined. The success of this plan could significantly impact the region's stability and the ongoing Israeli-Palestinian conflict, making it a topic of great interest and concern.

— Curated by the World Pulse Now AI Editorial System