Trading Day: Nvidia booms, Fed cools on easing

PositiveFinancial Markets

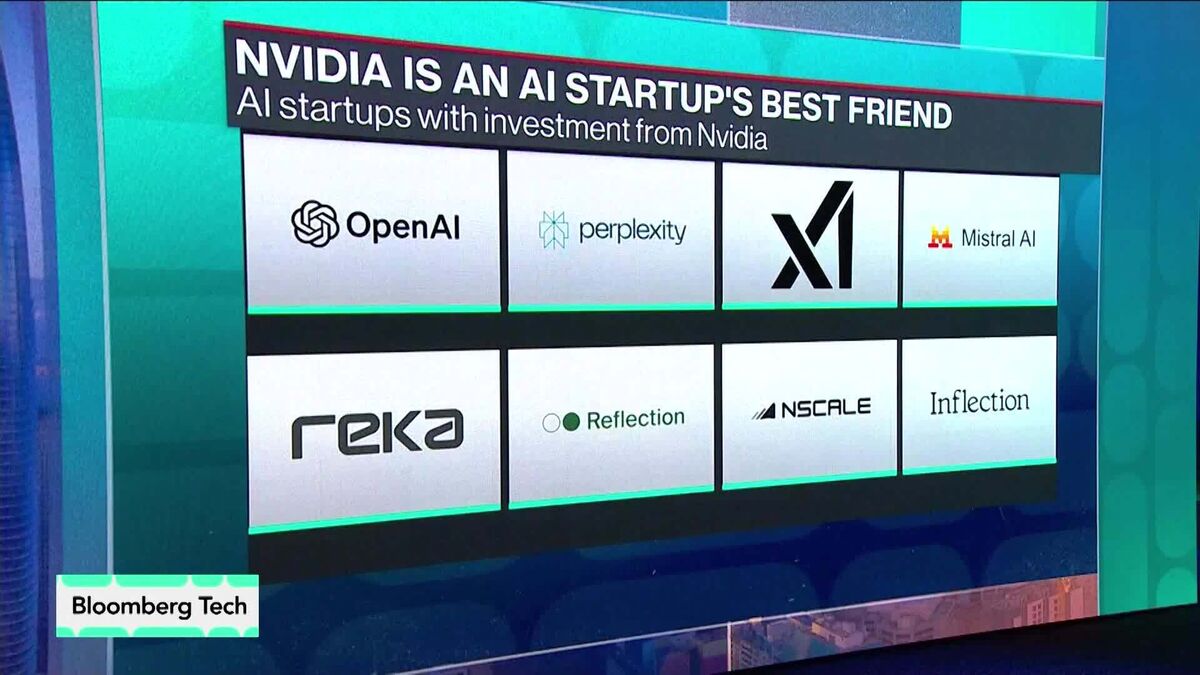

Nvidia's stock has seen a significant boom, reflecting strong investor confidence and robust performance in the tech sector. This surge is particularly noteworthy as the Federal Reserve signals a cautious approach towards easing monetary policy, which could impact market dynamics. The juxtaposition of Nvidia's growth against the Fed's stance highlights the resilience of certain sectors amidst broader economic uncertainties, making it a crucial moment for investors to watch.

— Curated by the World Pulse Now AI Editorial System