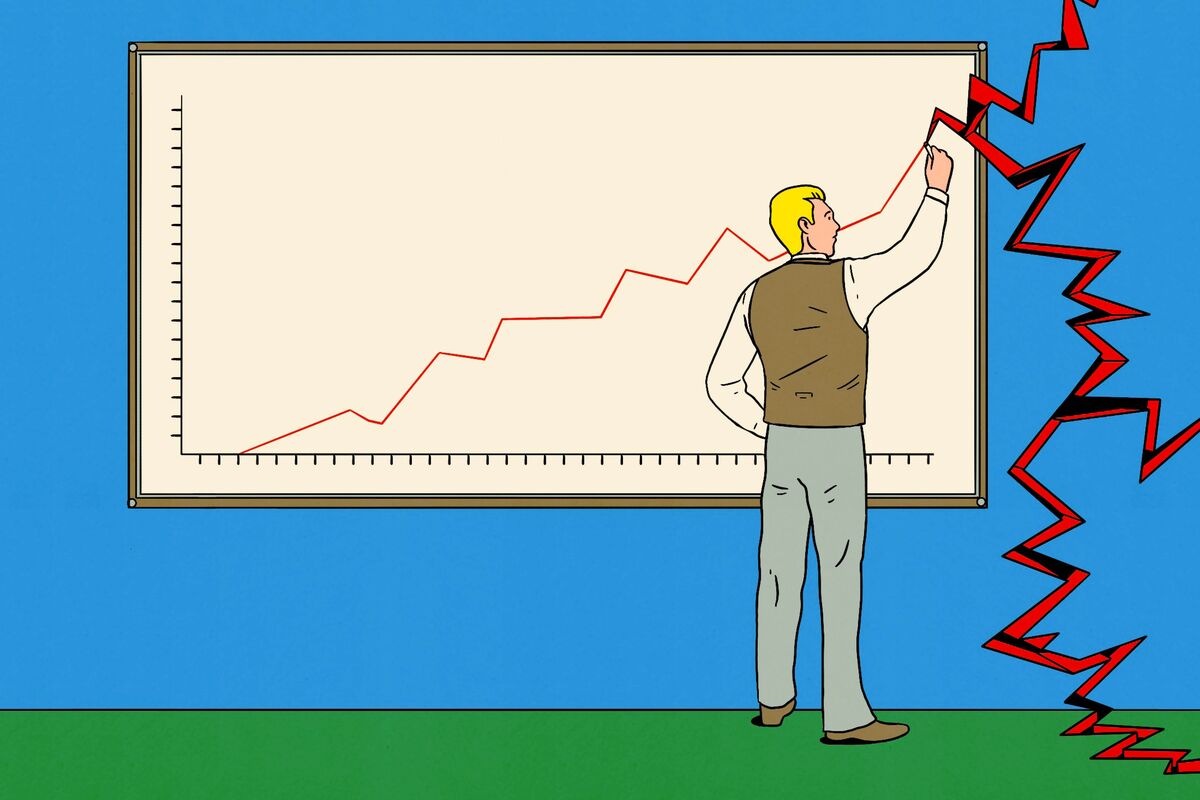

Markets would react badly to a surprise Reeves resignation, says ING

NegativeFinancial Markets

ING has warned that the markets would likely react negatively to any unexpected resignation from Reeves. This is significant because such a departure could create instability and uncertainty in the financial landscape, affecting investor confidence and market performance.

— Curated by the World Pulse Now AI Editorial System