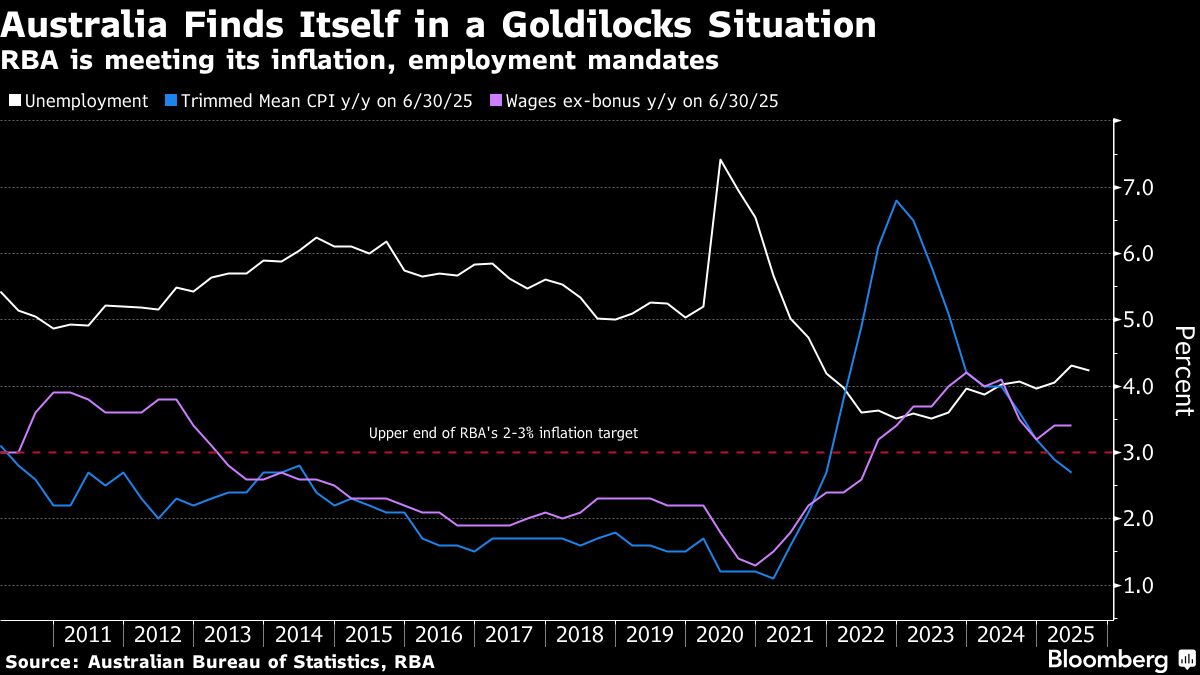

Australia Household Consumption Weakens, Adding to Rate-Cut Case

NegativeFinancial Markets

Australia's household consumption has shown a surprising decline in August, which raises concerns about the economy's health. This downturn could prompt the Reserve Bank to consider cutting interest rates soon, aiming to stimulate spending and support growth. It's a significant development as it reflects consumer confidence and spending power, which are crucial for economic stability.

— Curated by the World Pulse Now AI Editorial System