Block shares surge 62% following InvestingPro’s May Fair Value signal

PositiveFinancial Markets

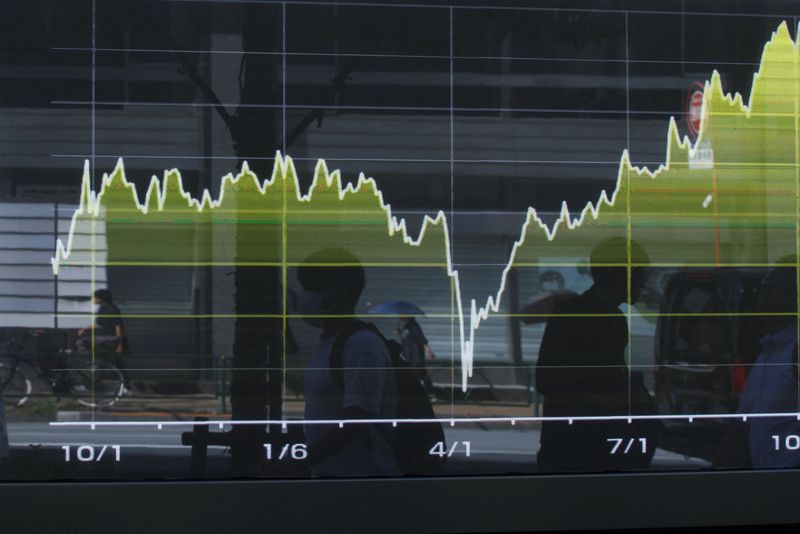

Block shares have seen a remarkable surge of 62% after InvestingPro issued a May Fair Value signal, indicating strong market confidence in the company's future. This significant increase highlights the positive sentiment surrounding Block and suggests that investors are optimistic about its growth potential. Such movements in stock prices can attract further investment and bolster the company's market position.

— Curated by the World Pulse Now AI Editorial System