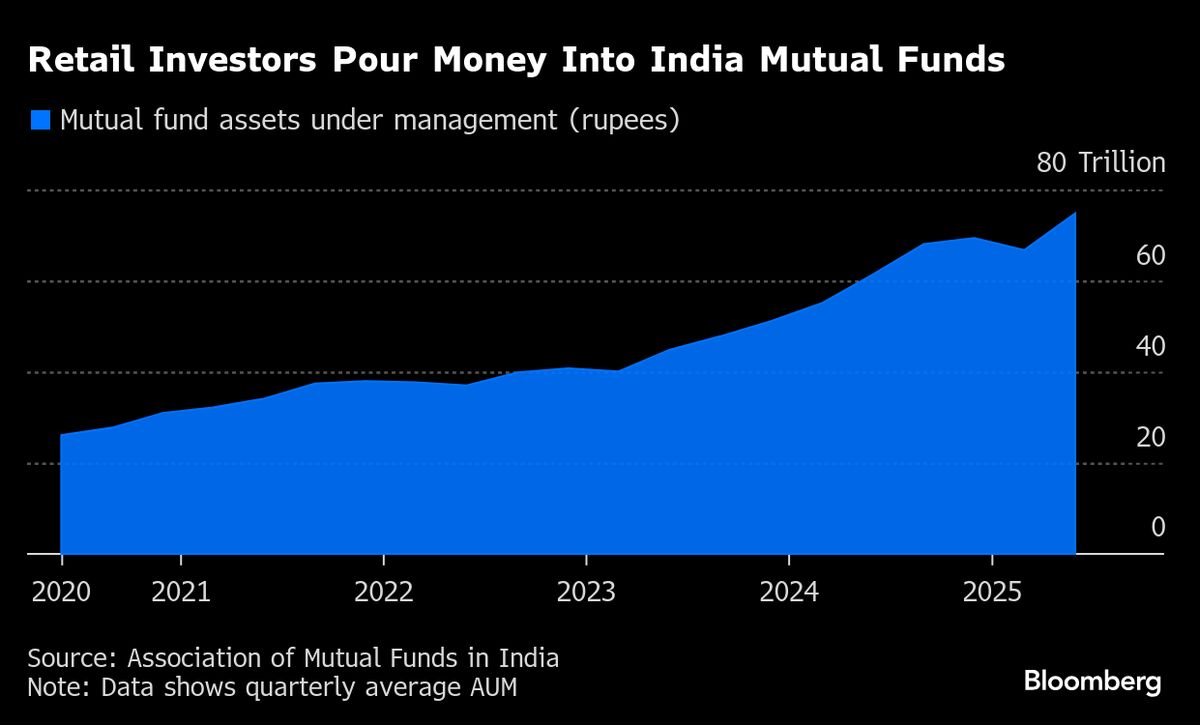

Jefferies Eyes Slice of India’s Fast-Growing Mutual Fund Market

PositiveFinancial Markets

Jefferies Financial Group Inc. is set to enter India's booming $900 billion asset-management industry, a move that highlights the growing interest of global financial giants in one of the fastest-growing economies. This expansion not only signifies Jefferies' confidence in the Indian market but also reflects the increasing opportunities for investment in the region, which could lead to enhanced financial services and products for local investors.

— Curated by the World Pulse Now AI Editorial System