BofA closes long CHF/JPY position as target reached amid Japan term-premium

NeutralFinancial Markets

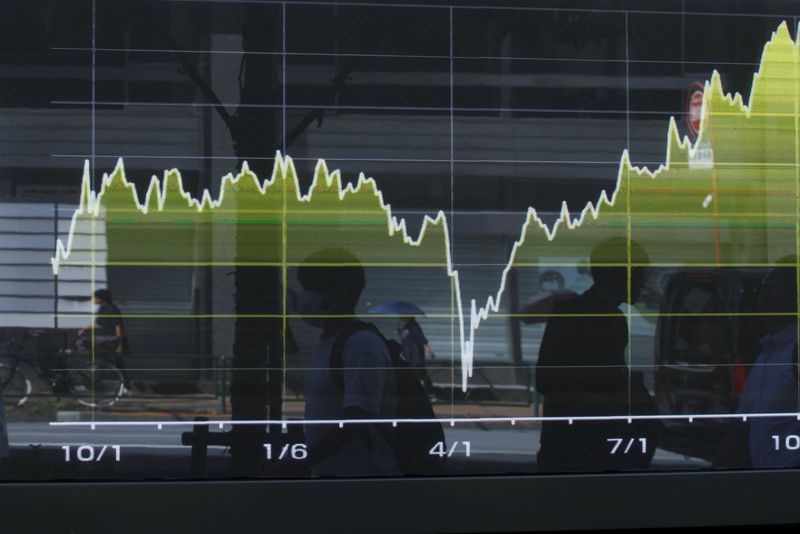

Bank of America has closed its long position in the Swiss franc against the Japanese yen after reaching its target. This move comes amid discussions about Japan's term premium, which reflects the additional yield investors demand for holding longer-term Japanese bonds. The decision highlights the bank's strategic approach to currency trading and its responsiveness to market conditions.

— Curated by the World Pulse Now AI Editorial System