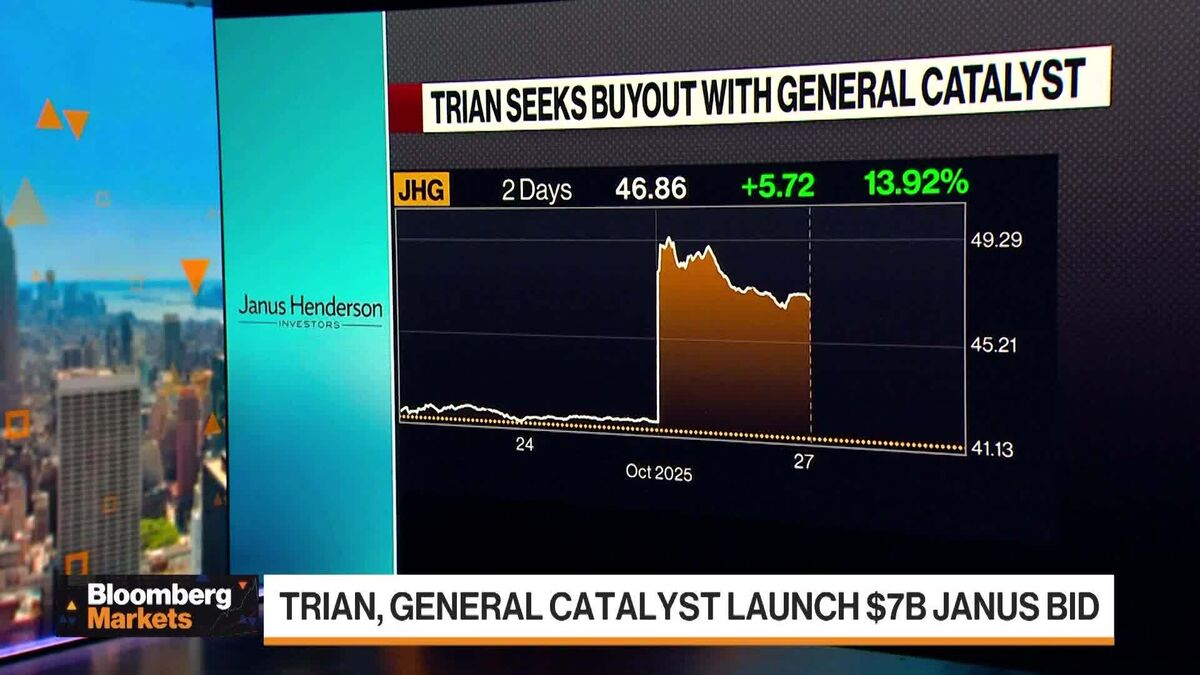

Janus Henderson Gets $7.2 Billion Offer From Trian, General Catalyst

PositiveFinancial Markets

Trian Fund Management and General Catalyst have made a significant move by offering $7.2 billion to acquire Janus Henderson, suggesting that the asset manager could thrive better as a private entity. This acquisition could lead to new strategies and improvements in operations, which is exciting news for investors and stakeholders alike.

— Curated by the World Pulse Now AI Editorial System