Bitcoin’s Fragile Rebound Follows $20 Billion Leverage Wipeout

NegativeFinancial Markets

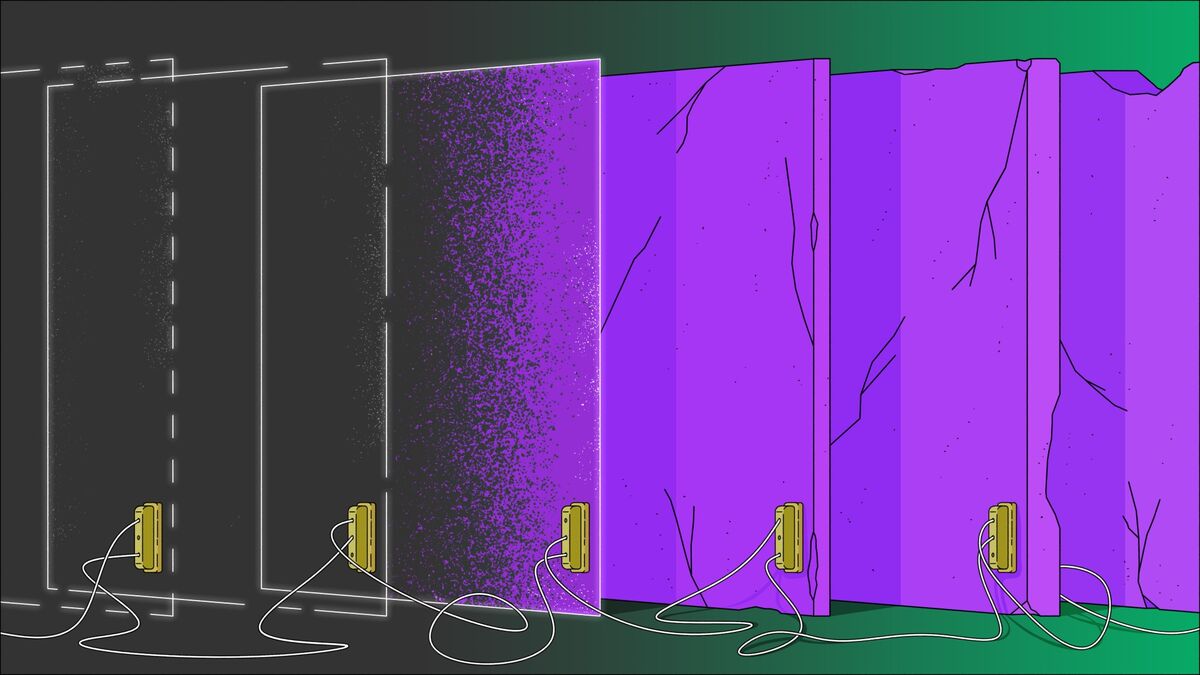

Bitcoin's recent recovery comes on the heels of a staggering $20 billion wipeout in leveraged bets, leaving the market in a precarious state. This significant downturn has not only erased months of speculative investments but has also forced some funds to exit the market entirely. The situation highlights the volatility and risks associated with cryptocurrency trading, making it a crucial moment for investors to reassess their strategies.

— Curated by the World Pulse Now AI Editorial System