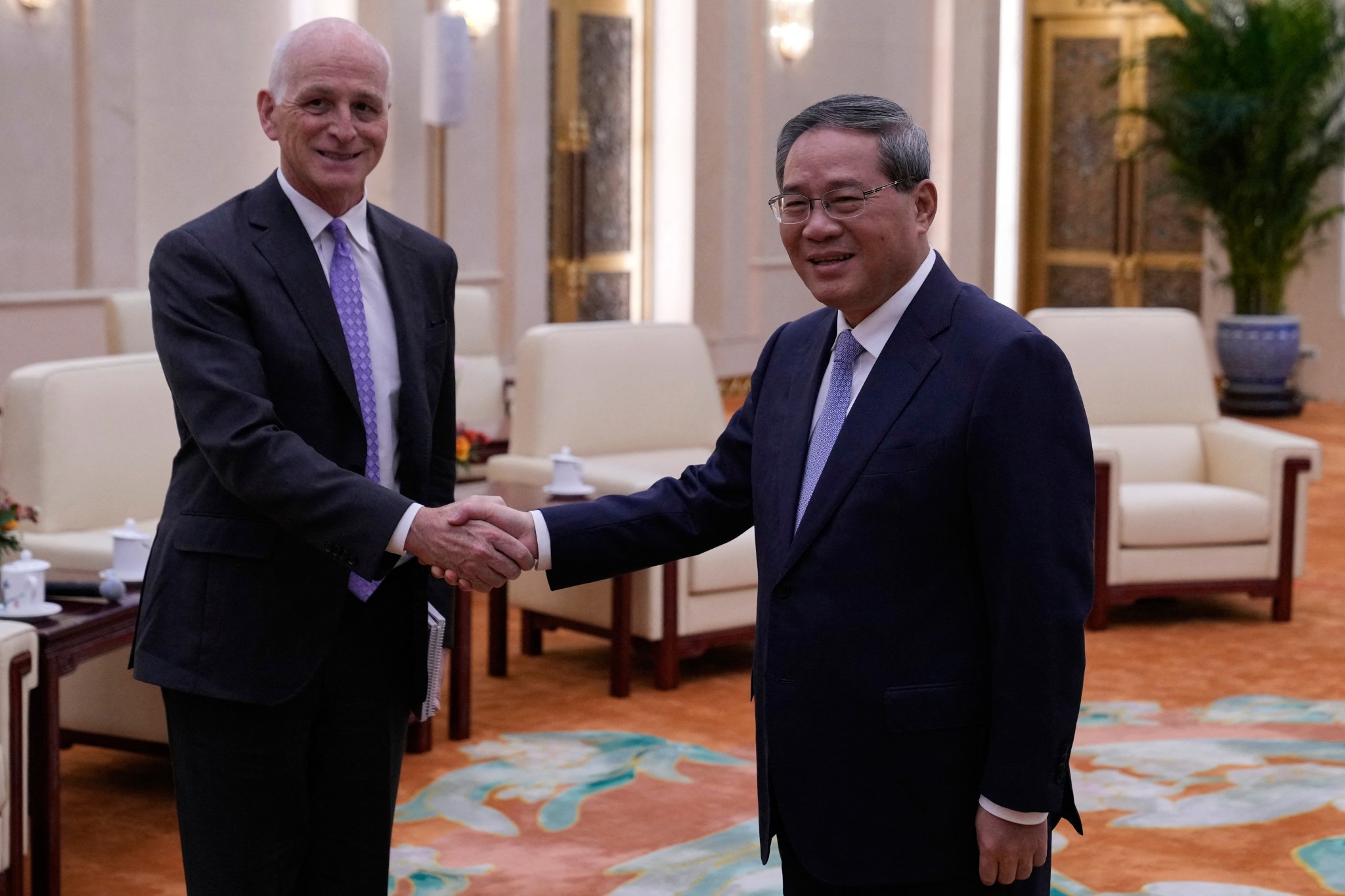

JPMorgan APAC CEO on India Business Strategy

PositiveFinancial Markets

Sjoerd Leenart, the Asia Pacific CEO of JPMorgan, recently highlighted India's potential as a 'bright spot' for the bank's business strategy during an interview at the JPMorgan India Conference in Mumbai. This positive outlook is significant as it reflects JPMorgan's commitment to expanding its presence in one of the world's fastest-growing economies, which could lead to increased investment and job creation in the region.

— Curated by the World Pulse Now AI Editorial System