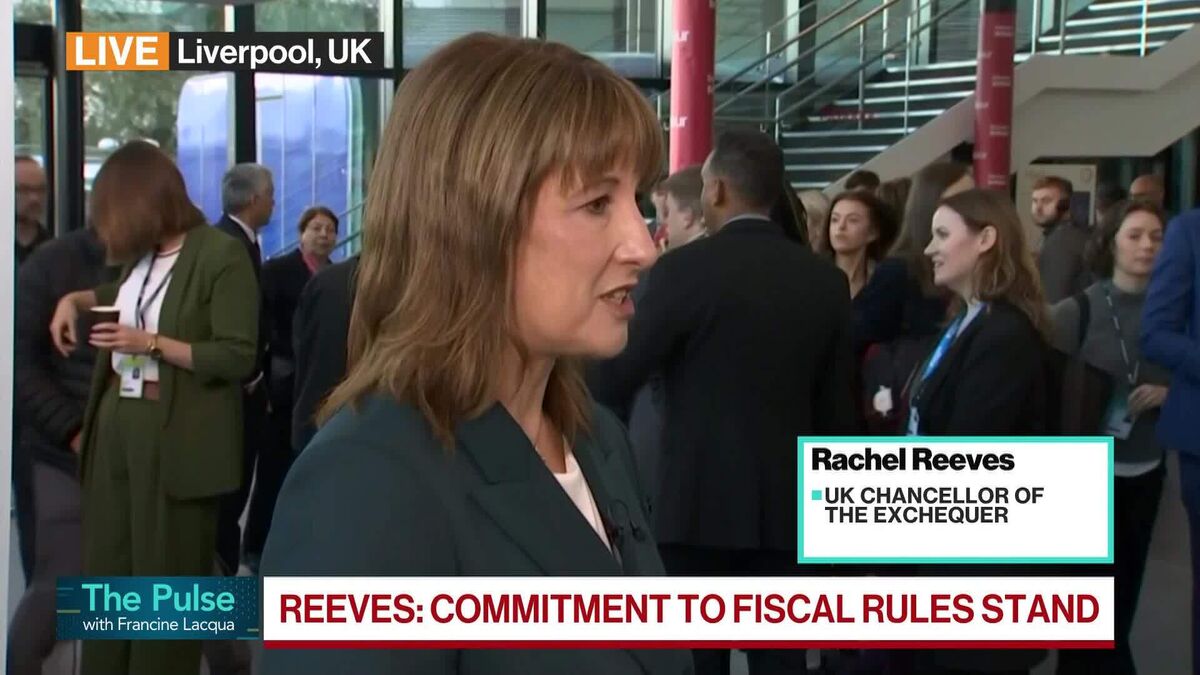

UK shop prices rise at fastest pace since February 2024

NegativeFinancial Markets

UK shop prices have surged at their fastest rate since February 2024, signaling growing inflationary pressures that could impact consumers' purchasing power. This rise in prices is concerning as it suggests that everyday goods are becoming more expensive, which may lead to tighter budgets for families and individuals. Understanding these trends is crucial for consumers and policymakers alike, as they navigate the economic landscape.

— Curated by the World Pulse Now AI Editorial System