Indian Oil Seeks Barrels From the Americas on Russia Caution

NeutralFinancial Markets

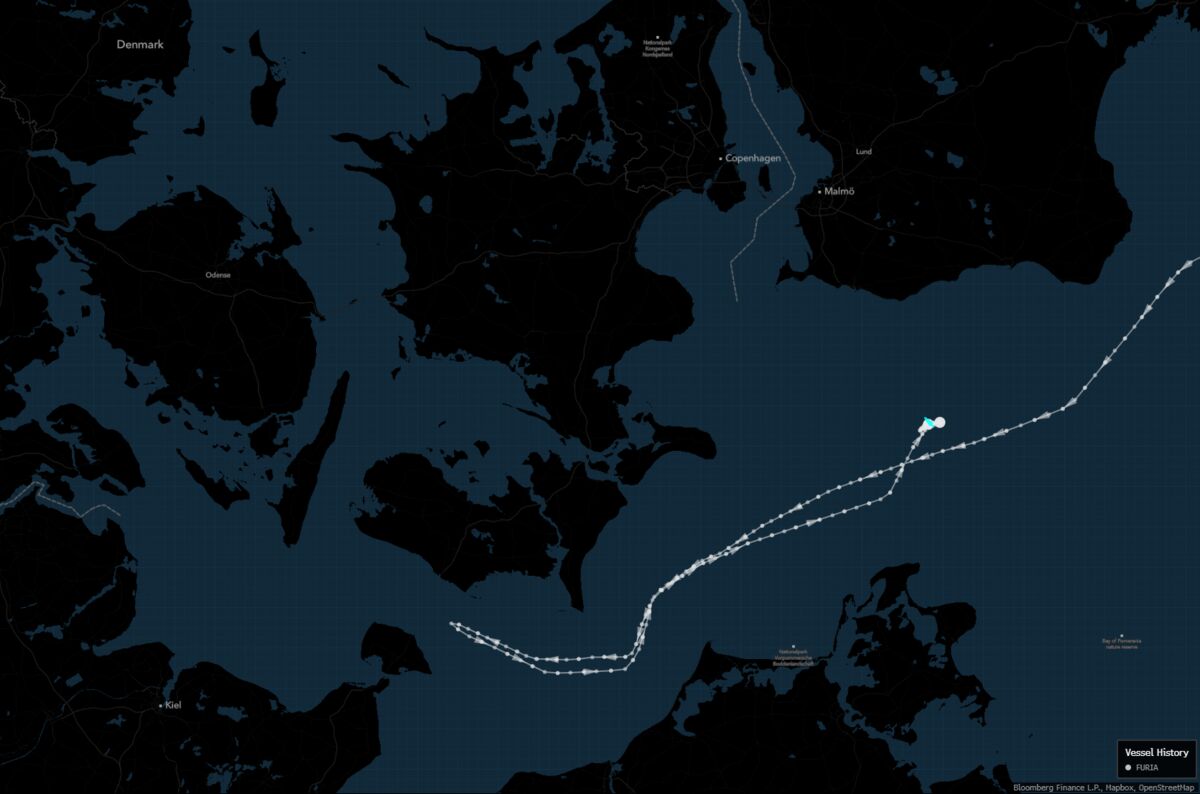

Indian Oil Corp. is looking to secure up to 24 million barrels of crude oil from the Americas in the first quarter of next year. This move comes as the company prepares for potential disruptions in Russian oil supply due to new US sanctions. This is significant as it highlights the ongoing shifts in global oil markets and the impact of geopolitical tensions on energy sourcing.

— Curated by the World Pulse Now AI Editorial System