Mamdani ‘Brilliant' for Affordability Focus: Kimball

PositiveFinancial Markets

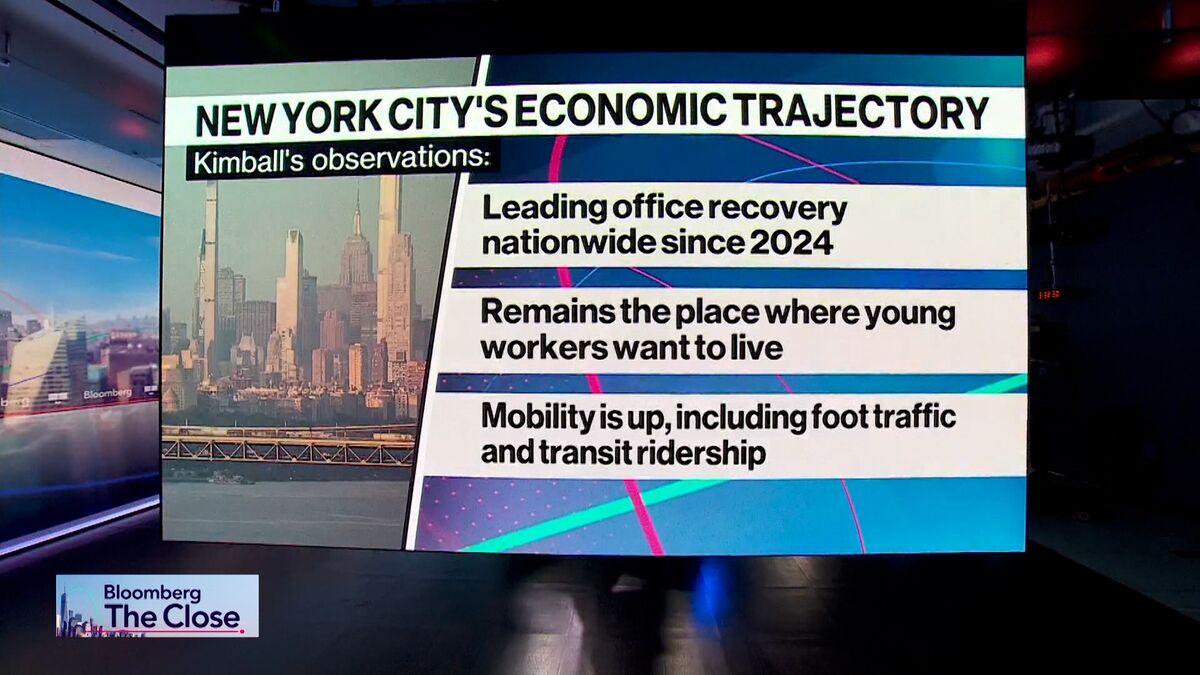

- Andrew Kimball, President & CEO of the NYC Economic Development Corporation, praised the Mayor-elect's emphasis on affordability, noting its resonance with voters. He highlighted that affordability is a critical economic development issue essential for the city's future stability and growth.

- This focus on affordability is significant as it aligns with the pressing needs of New Yorkers, potentially influencing policy decisions and economic strategies that could enhance living conditions and support local businesses in the long term.

- The discussion around affordability is increasingly relevant as experts, including former HUD Secretary Shaun Donovan, warn of an unprecedented affordability crisis in the U.S., underscoring the need for effective solutions to address this pressing economic challenge.

— via World Pulse Now AI Editorial System