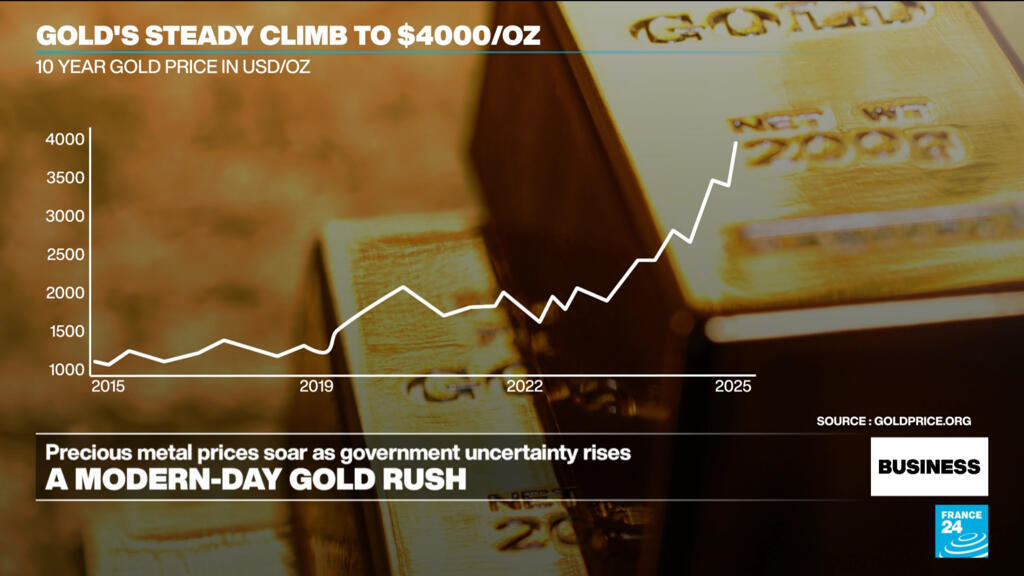

Spot gold rises above $4,000 for the first time; car dealer Vertu Motors warns of £5.5m profit hit from JLR disruption – business live

PositiveFinancial Markets

Spot gold has reached a historic milestone, surpassing $4,000 for the first time, reflecting a significant 50% increase this year, driven by central bank purchases and ongoing political instability. This surge in gold prices is noteworthy as it indicates a growing trend among investors seeking safe-haven assets amid economic uncertainty. Meanwhile, Vertu Motors has reported a £5.5 million profit hit due to disruptions from Jaguar Land Rover, highlighting challenges in the automotive sector. The retirement of Peter Hargreaves, co-founder of Hargreaves Lansdown, adds another layer of change in the investment landscape.

— Curated by the World Pulse Now AI Editorial System