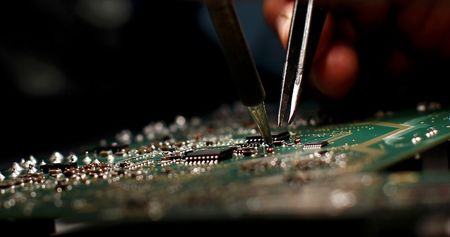

Samsung, SK Hynix hike memory prices by up to 30% in Q4- report

PositiveFinancial Markets

Samsung and SK Hynix have announced a significant price increase for memory products, raising prices by up to 30% in the fourth quarter. This move is noteworthy as it reflects the ongoing demand for memory chips in various sectors, including consumer electronics and data centers. The price hike could impact manufacturers and consumers alike, potentially leading to higher costs for devices that rely on these essential components.

— Curated by the World Pulse Now AI Editorial System