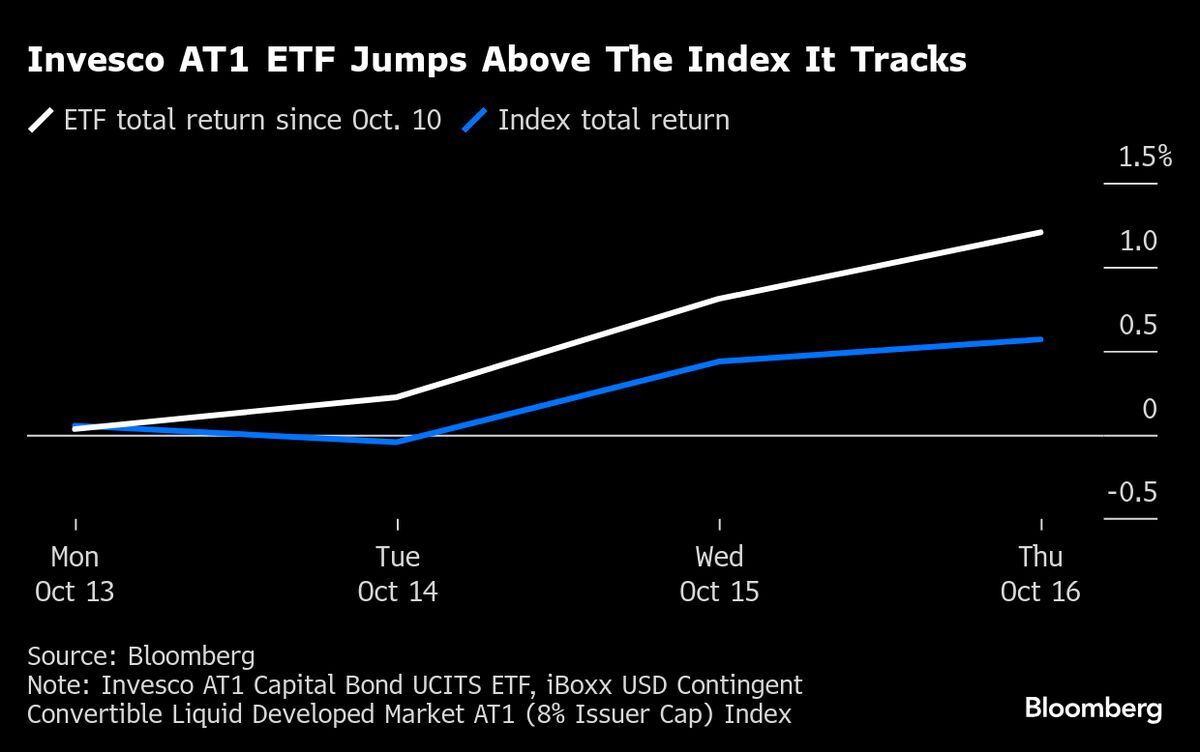

Bets on Wiped-Out Credit Suisse Debt Supercharge Invesco AT1 ETF

PositiveFinancial Markets

Traders are increasingly focusing on an exchange-traded fund (ETF) as they seek potential compensation from the wiped-out Additional Tier 1 debt of Credit Suisse Group AG. This move highlights the growing interest in financial instruments that could offer recovery opportunities for investors affected by the bank's recent turmoil. It matters because it reflects a proactive approach by traders to navigate the complexities of the financial market and capitalize on potential gains.

— Curated by the World Pulse Now AI Editorial System