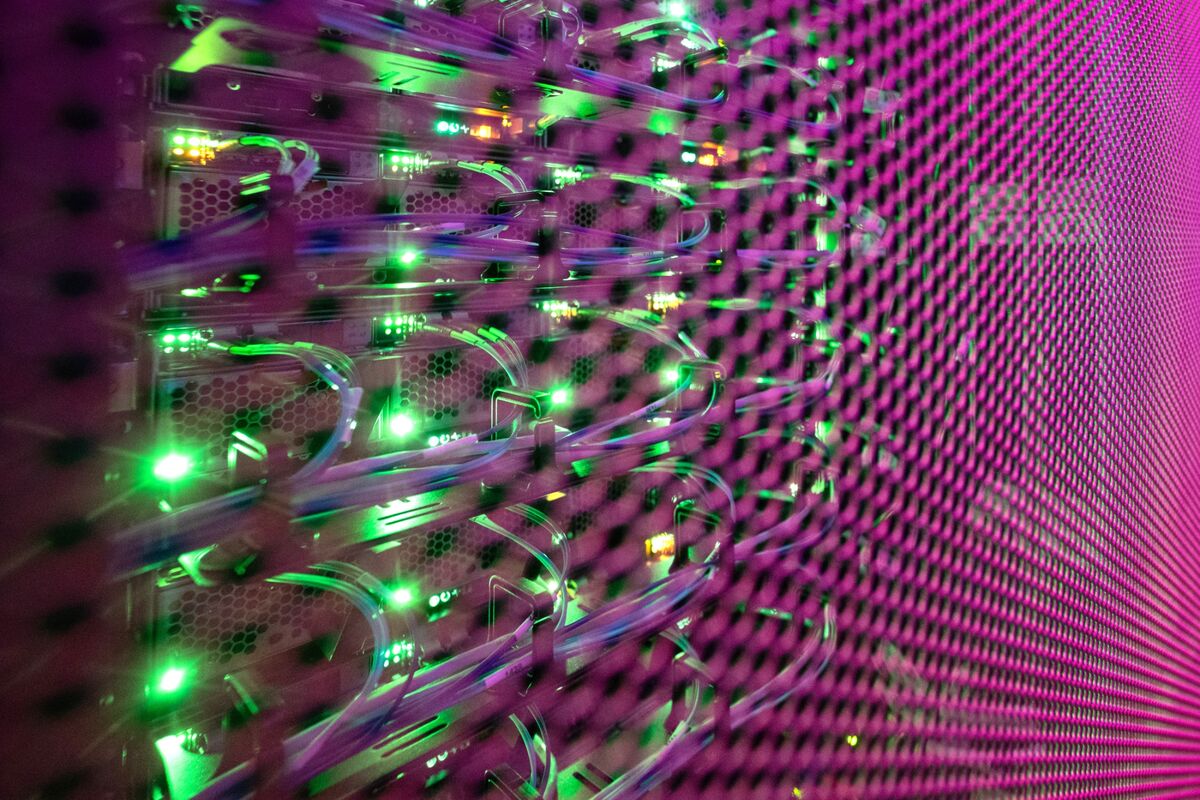

Deutsche explores hedges for data centre exposure as AI lending booms

NeutralFinancial Markets

Deutsche Bank is exploring various strategies to manage its exposure to data centers amid the growing demand for AI lending. Executives are considering options such as shorting a basket of AI stocks or utilizing derivatives to effectively transfer risk.

— Curated by the World Pulse Now AI Editorial System