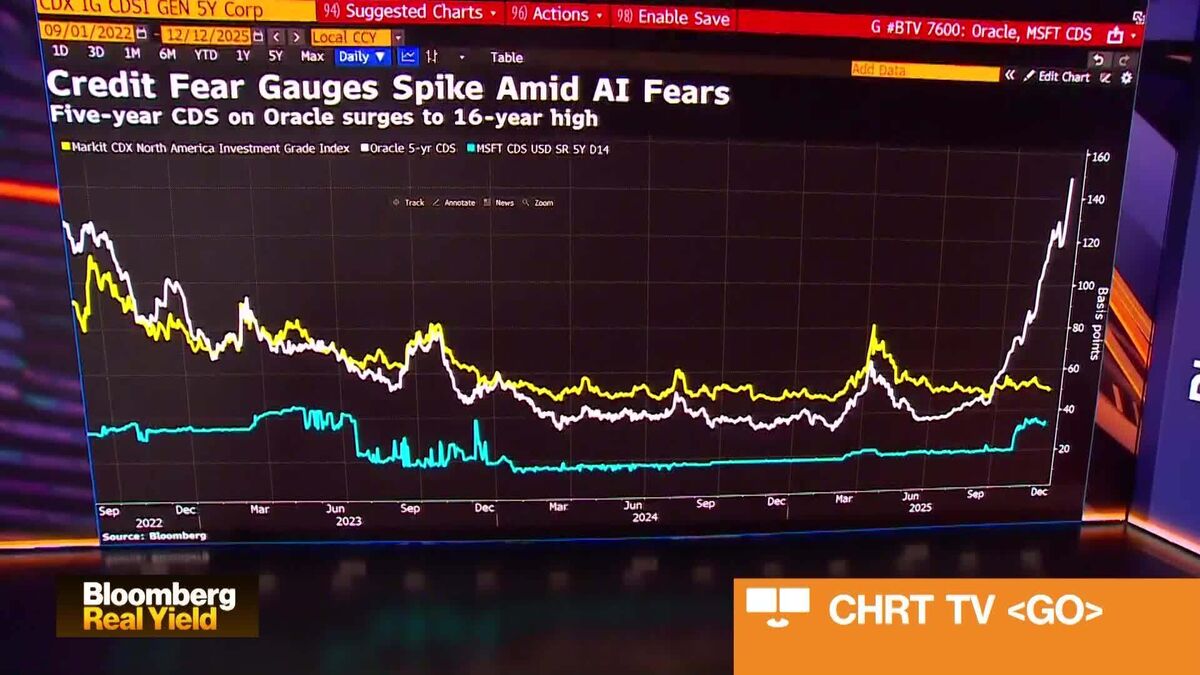

Overall Spreads Remain Tight Even As Oracle Debt Risk Jumps

NegativeFinancial Markets

- Credit spreads remain tight despite a significant increase in debt risk associated with Oracle, as discussed by Maureen O'Connor of Wells Fargo and Amanda Lynam of BlackRock on Bloomberg Real Yield. The ongoing AI development boom is driving a massive demand for debt, with estimates suggesting infrastructure costs could reach $10 trillion, raising concerns of a potential bubble.

- This situation is critical for financial institutions like Wells Fargo and BlackRock, as they navigate the complexities of high-grade debt issuance amidst rising risks. The shift in investment strategies, particularly BlackRock's bearish stance on long-term Treasuries, reflects a cautious approach to the evolving market dynamics.

- The broader implications of this debt frenzy highlight ongoing concerns about the sustainability of AI funding and the potential for an economic bubble. As experts express worries about the impact of AI developments on financial markets, the conversation around interest rate adjustments by the Federal Reserve adds another layer of complexity to the credit landscape.

— via World Pulse Now AI Editorial System