Santos, Shell, Woodside Signal Support for Australian Domestic Gas Reservation

PositiveFinancial Markets

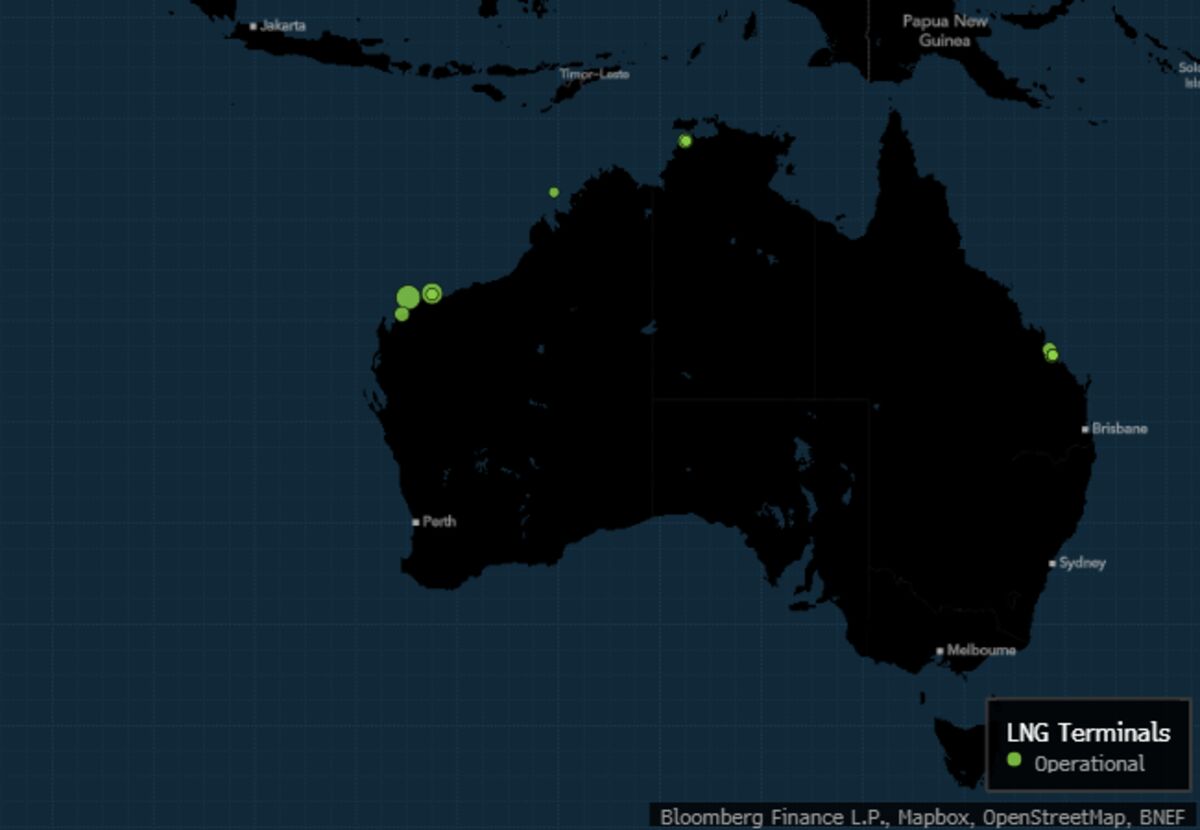

Australia's energy sector is showing strong support for a new policy that would mandate gas producers to reserve a portion of their output for domestic use. This initiative is crucial as the country faces a potential local supply shortage while also aiming to capitalize on profitable export opportunities. By ensuring that enough gas is available for local consumption, the policy could help stabilize the energy market and protect consumers, making it a significant step forward for Australia's energy strategy.

— Curated by the World Pulse Now AI Editorial System