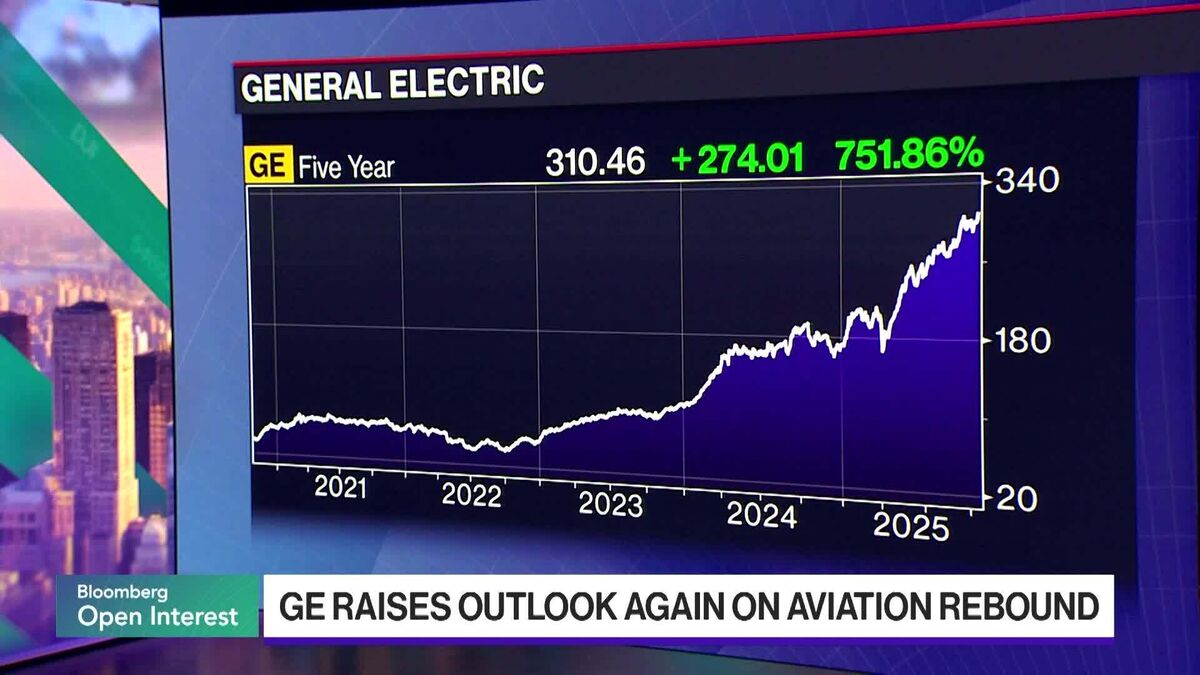

GE Hikes Outlook Again on Jet Boom

PositiveFinancial Markets

General Electric has once again raised its annual forecast, driven by a surge in air travel that is boosting demand for jet engines and maintenance services. With a remarkable 26% increase in revenue last quarter, totaling $11.3 billion, GE is benefiting from strong maintenance work and new engine deliveries to major players like Boeing and Airbus. This positive trend not only highlights the recovery of the aviation industry but also positions GE favorably in a competitive market.

— Curated by the World Pulse Now AI Editorial System