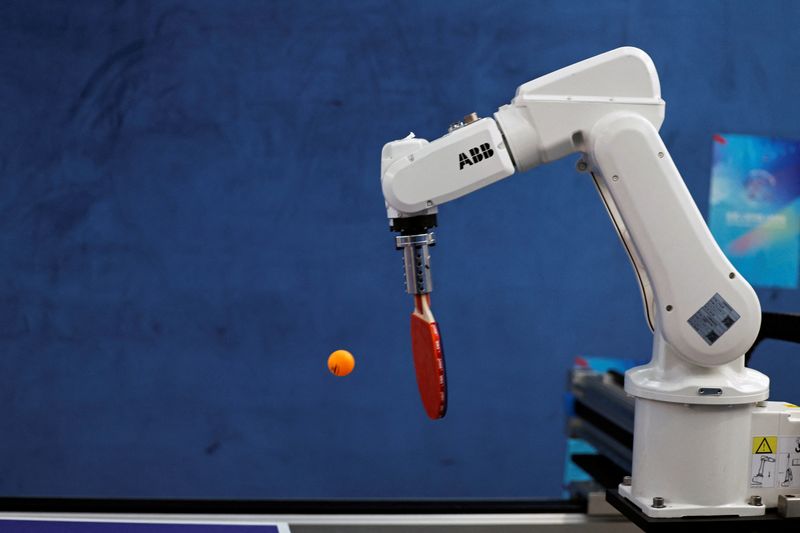

SoftBank Expands AI Footprint With Multibillion-Dollar Robotics Deal

PositiveFinancial Markets

SoftBank is making a significant move in the robotics sector with its multibillion-dollar acquisition of ABB, marking a pivotal moment in its investment journey. This deal not only highlights SoftBank's commitment to expanding its AI footprint but also reflects the growing importance of robotics in today's technology landscape. With Masayoshi Son at the helm, this acquisition could lead to innovative advancements and strengthen SoftBank's position in the competitive market.

— Curated by the World Pulse Now AI Editorial System