Teva Hits Highest Since 2018 as 3Q Revenue Beats Estimates

PositiveFinancial Markets

Teva Hits Highest Since 2018 as 3Q Revenue Beats Estimates

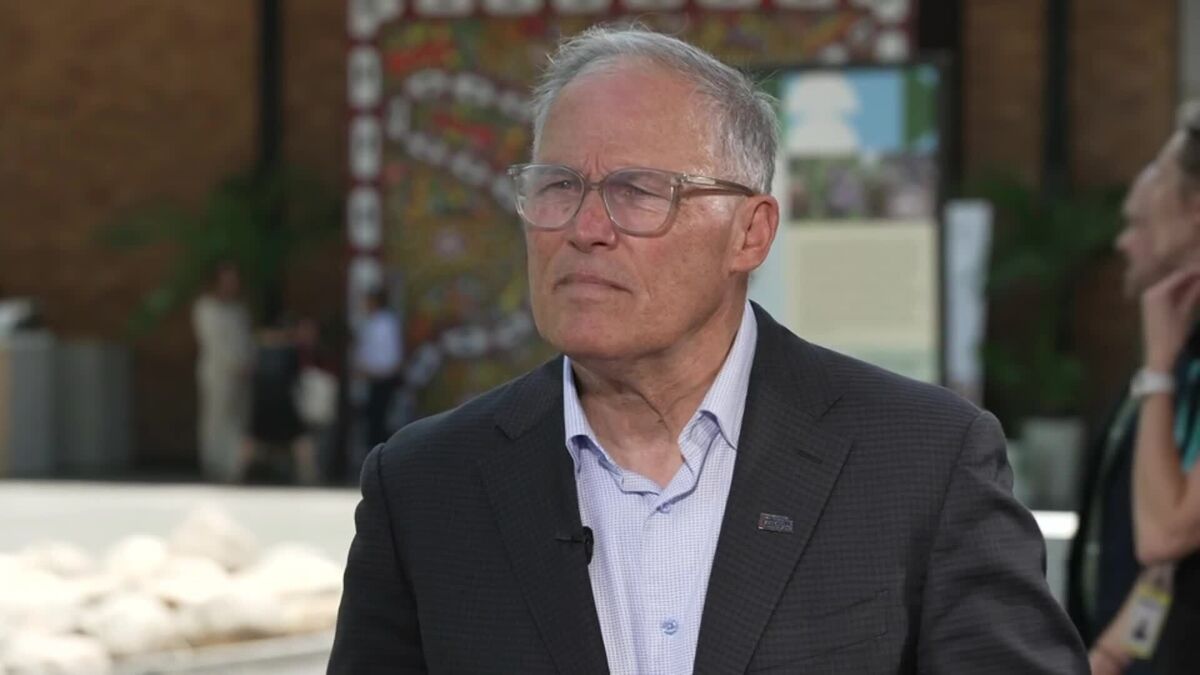

Teva Pharmaceutical has reached its highest stock price since 2018, following a third-quarter revenue report that exceeded analysts' expectations. This positive financial performance is significant as it reflects the company's recovery and growth potential in a competitive market. CEO Richard Francis discussed these results on Bloomberg BusinessWeek, highlighting the company's strategic direction and commitment to innovation.

— via World Pulse Now AI Editorial System