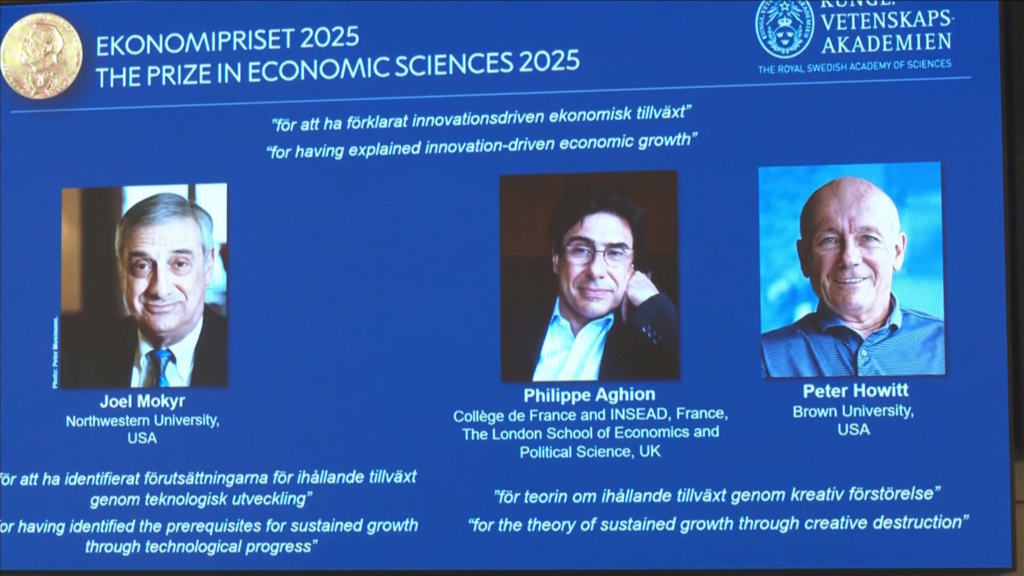

Five Immigrants To America Won 2024 And 2025 Nobel Prize In Economics

PositiveFinancial Markets

In a remarkable achievement, five immigrants to America have been awarded the Nobel Prize in Economics for 2024 and 2025, with four of them being former international students. This recognition highlights the significant contributions that immigrants make to the academic and economic landscape of the United States, showcasing the importance of diversity and innovation in driving progress.

— Curated by the World Pulse Now AI Editorial System