Morning Bid: Rattled tech stokes volatility

NeutralFinancial Markets

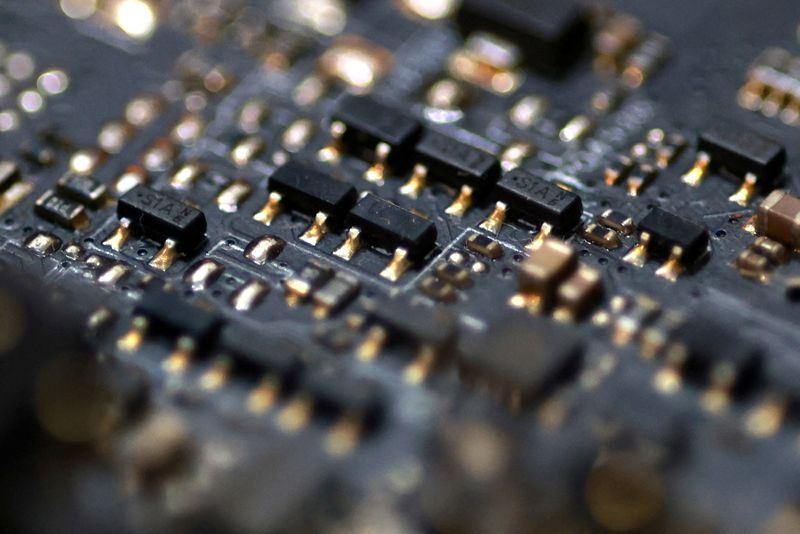

- The technology sector is currently facing significant volatility, with investor anxiety heightened by concerns over stock valuations and potential interest rate cuts. This situation has led to a cautious approach among investors, particularly in the tech industry, as they navigate the uncertain market landscape.

- The implications of this volatility are profound for tech companies, as fluctuating stock prices can impact their market positions and investor confidence. Companies are under pressure to demonstrate stability and growth amidst these challenges.

- Broader market trends indicate a growing divide between small

— via World Pulse Now AI Editorial System