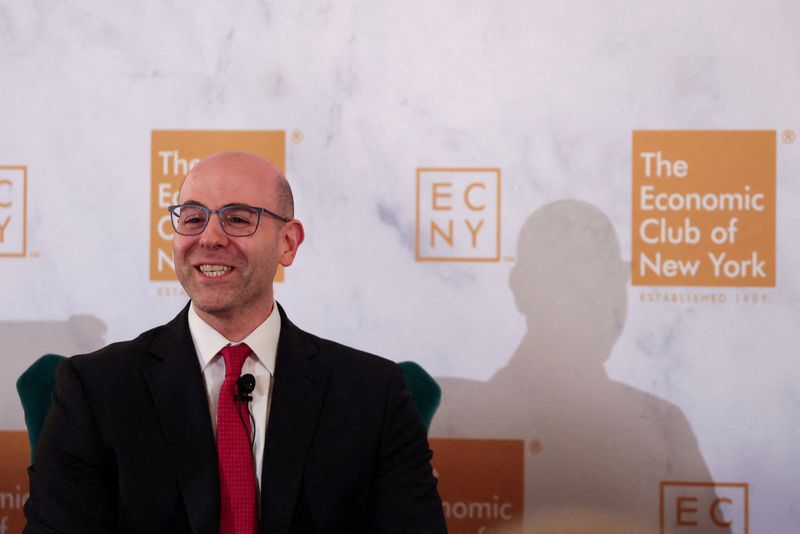

Fed Governor Miran advocates for further rate cuts

PositiveFinancial Markets

Fed Governor Miran has recently advocated for further rate cuts, suggesting that such measures could stimulate economic growth and help combat inflation. This is significant as it reflects a proactive approach by the Federal Reserve to support the economy during uncertain times, potentially leading to increased consumer spending and investment.

— Curated by the World Pulse Now AI Editorial System