Chinese rare earth stocks surge as Beijing expands export controls

PositiveFinancial Markets

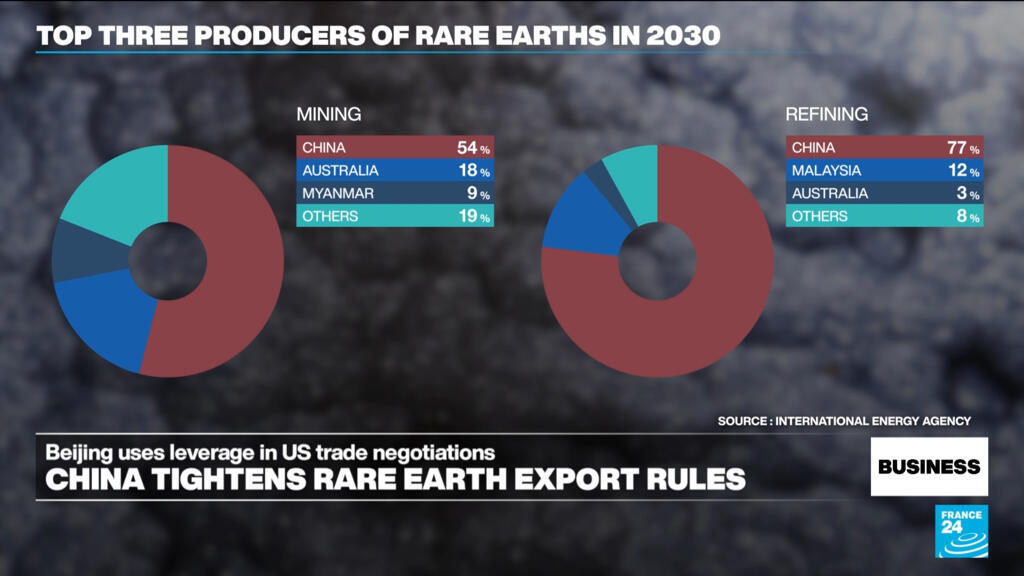

Chinese rare earth stocks have seen a significant surge following Beijing's decision to expand export controls. This move is crucial as it not only impacts the global supply chain but also highlights China's strategic position in the rare earth market. Investors are optimistic about the potential for increased prices and demand, making this a pivotal moment for the industry.

— Curated by the World Pulse Now AI Editorial System