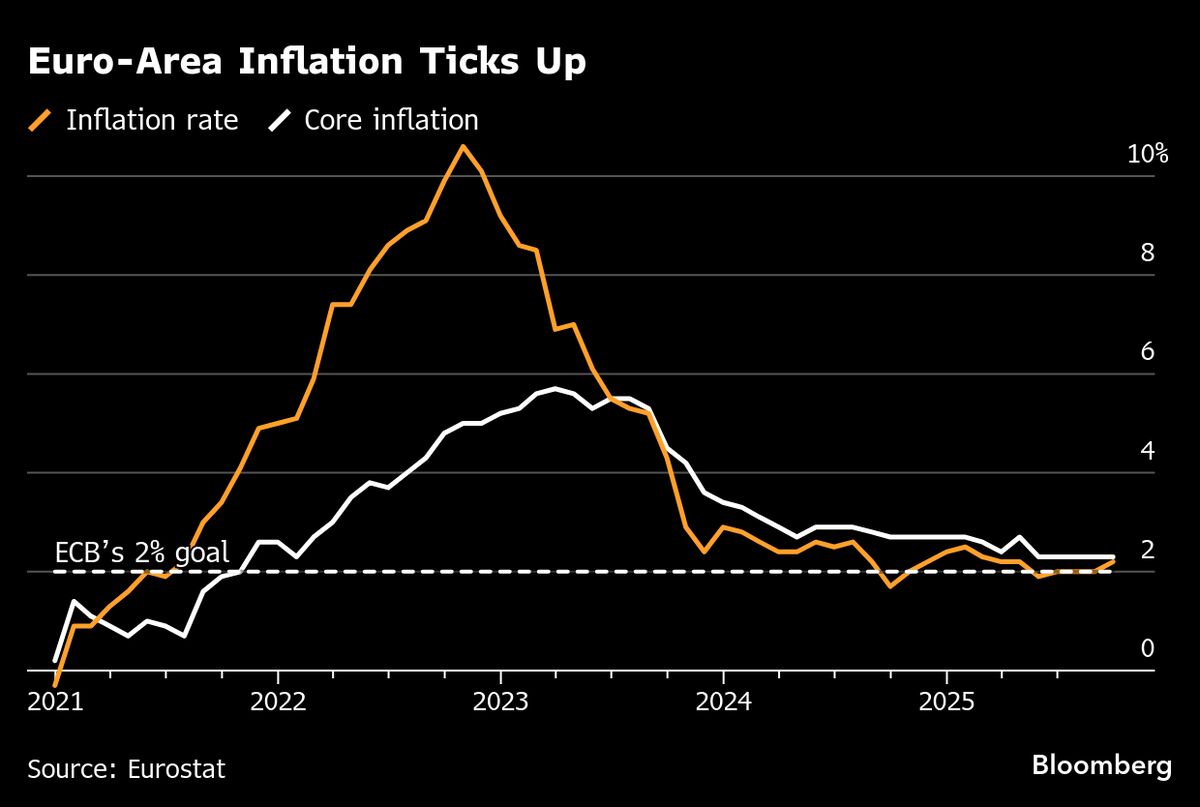

Euro-Zone Inflation Quickens, Backing ECB Caution on Rates

NeutralFinancial Markets

In September, inflation in the euro-area picked up speed, which reinforces the European Central Bank's decision to maintain current interest rates. This development is significant as it indicates ongoing economic pressures, prompting the ECB to adopt a cautious approach in its monetary policy.

— via World Pulse Now AI Editorial System