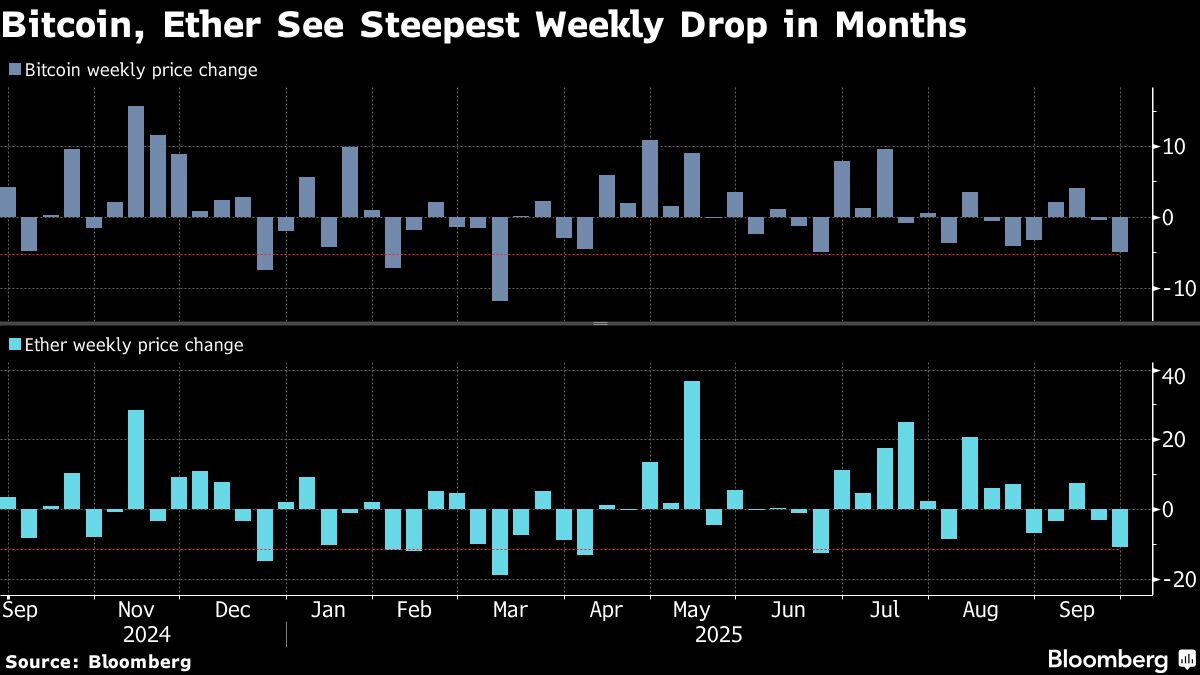

Crypto’s $300 Billion Wipeout Marks Harshest Selloff in Months

NegativeFinancial Markets

This week, the cryptocurrency market experienced a significant downturn, losing around $300 billion in value due to a wave of leveraged bets that fell apart. This selloff has severely impacted major tokens and has led to the weakest market sentiment seen since early summer. Such drastic fluctuations in the crypto market highlight the volatility and risks associated with digital currencies, affecting investors and the broader financial landscape.

— Curated by the World Pulse Now AI Editorial System