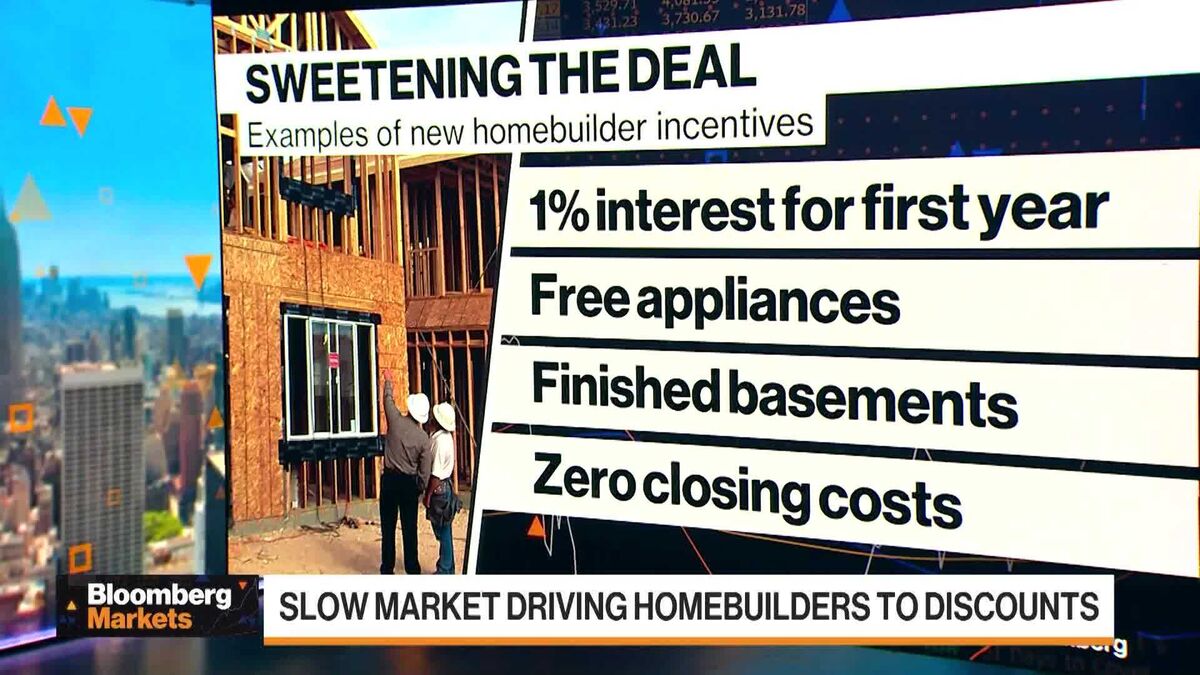

Homebuilders Bet on 1% Mortgage Rates to Wake Up US Buyers

PositiveFinancial Markets

Homebuilders Bet on 1% Mortgage Rates to Wake Up US Buyers

Homebuilders are optimistic as they anticipate a drop in mortgage rates to around 1%, which could significantly boost homebuying activity in the U.S. Currently, with rates hovering near 6%, buyers are already experiencing the most affordable monthly payments in a year. Real estate agent Tavyn Weyman from San Antonio is leading the charge by finding ways to lower these costs even further, making homeownership more accessible. This shift could revitalize the housing market and provide a much-needed boost to the economy.

— via World Pulse Now AI Editorial System