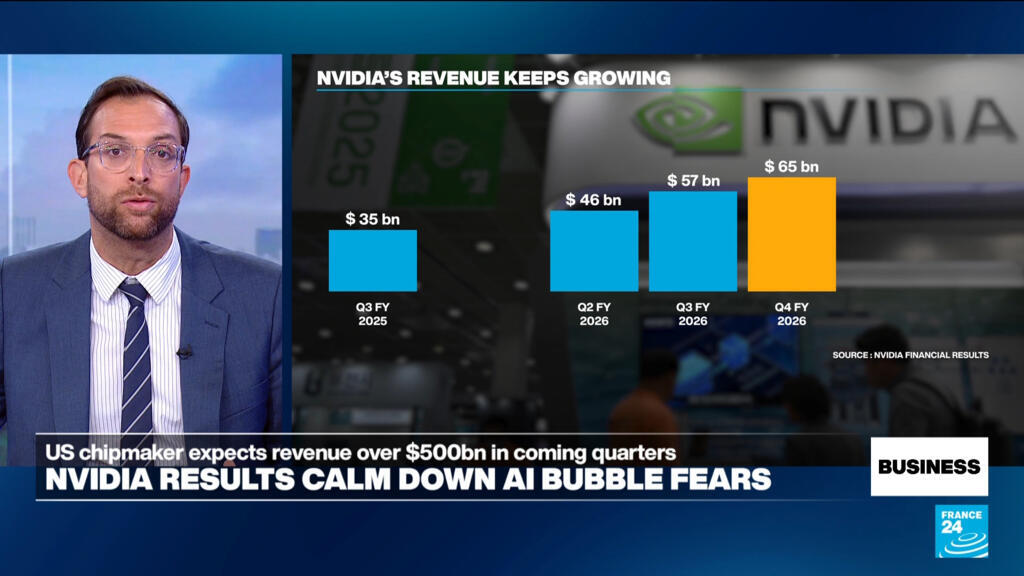

Nvidia's upbeat forecast for future demand calms 'AI bubble' fears

PositiveFinancial Markets

- Nvidia's recent earnings report showed a significant 62% increase in revenue year

- This strong performance underscores Nvidia's dominant position in the AI chip market, reflecting robust demand for its products and enhancing investor confidence.

- Amidst ongoing concerns about market volatility and potential overvaluation of AI stocks, Nvidia's optimistic outlook stands in contrast to broader market trends, highlighting the company's resilience and strategic growth plans.

— via World Pulse Now AI Editorial System