Bavarian Nordic Takeover Standoff Turns Into Struggle for Power

NeutralFinancial Markets

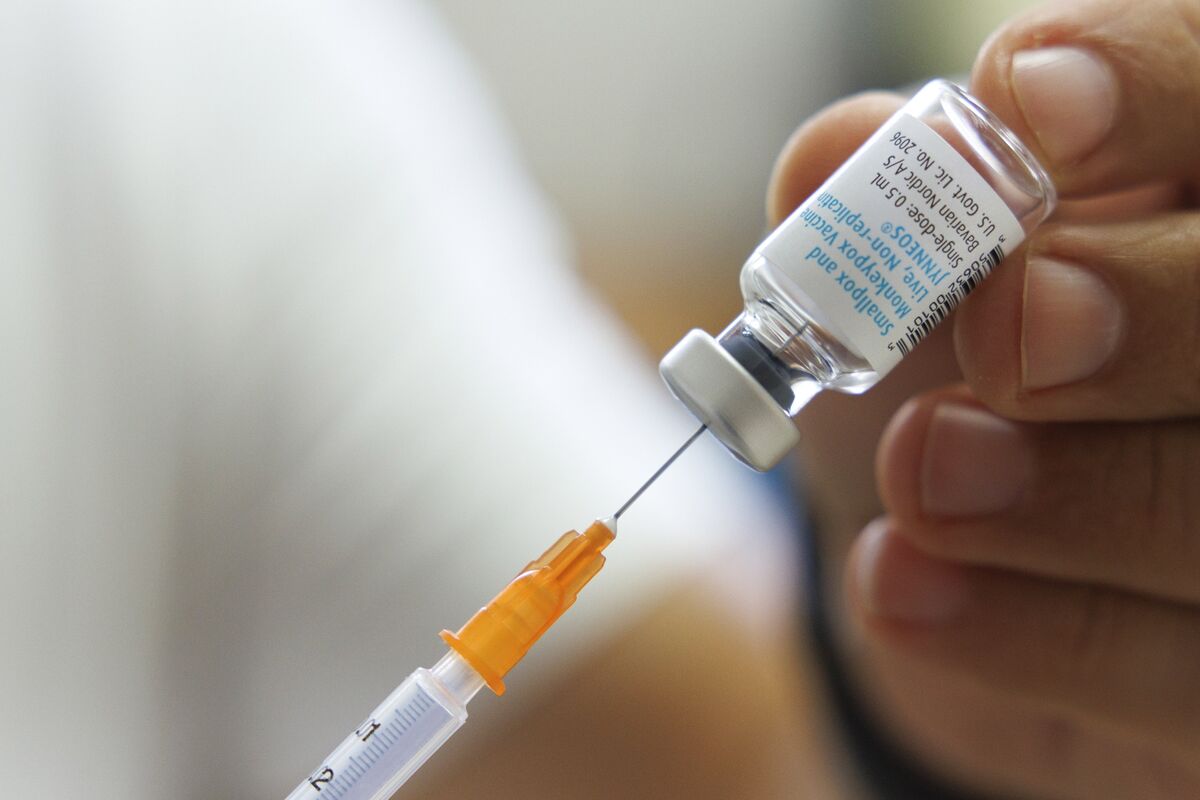

The ongoing takeover standoff involving Bavarian Nordic A/S has sparked intense discussions among retail shareholders on Danish investment forums, resembling a battlefield of opinions and strategies. This situation is significant as it highlights the complexities of corporate takeovers and the active role that individual investors can play in shaping the outcome of such high-stakes negotiations.

— Curated by the World Pulse Now AI Editorial System