Mastercard's Seshadri On Future of B2B Payments

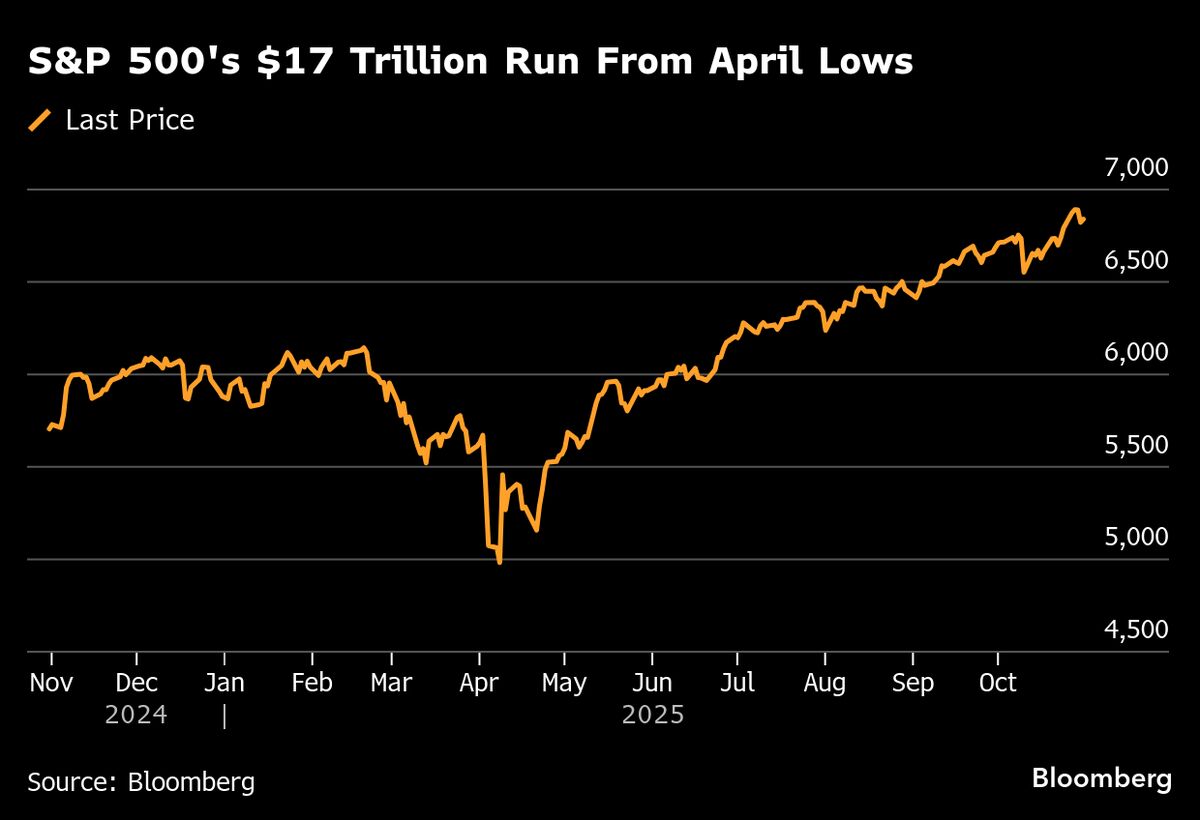

PositiveFinancial Markets

In a recent interview, Mastercard's Chief Commercial Payments Officer Raj Seshadri shared insights on the evolving landscape of B2B payments, particularly highlighting trends in cross-border transactions. This discussion is significant as it sheds light on how businesses can adapt to changing payment technologies and improve their financial operations, ultimately driving efficiency and growth in the global market.

— Curated by the World Pulse Now AI Editorial System